Closing prices 19.07.2024

British near-term gas prices declined on Monday, with the NBP spot price falling approximately 2% settling at 2.4 p/kWh due Norwegian flows reaching their highest levels this month, following the resolution of unplanned outages last week. Along the forward curve, the gas price for Winter 2024 decreased by just below 0.9%, ending at 3.2 p/kWh, influenced by forecasts of decreased LNG imports.

British near-term gas prices dropped this Wednesday. NBP spot price fell by over 4% to end at 2.5 p/kWh, amid an oversupply situation. Along the forward curve, the gas price for Winter 2024 decreased as well by just nearly 2% to close at 3.2 p/kWh driven by the partial restart of the US Freeport LNG facility this week.

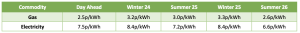

At time of writing, European gas storage levels are 82% full, with the UK 50% full. 2023/24 European gas storage levels have ended Winter 23 at record levels. Over the past week gas has accounted for 28% of the UK generation mix with wind accounting for 18%, solar 9% and nuclear accounting for 16%. Below summarises curve prices as at close of business on Friday.

Curve UK Gas & Electricity Markets

Other Energy Markets

Oil prices decreased on Monday, influenced by China’s underperforming economy despite the Houthis attacks in the red sea causing higher shipping costs. As a result, Brent crude decreased by just over 0.2% to end at $84.85 a barrel, while WTI crude fell by approximately 0.4% setting at $81.91 a barrel.

European carbon prices decreased on Wednesday, amid technical trading and in the absence of firm fundamental drivers. As a result, EUAs expiring in December 2024 2.2%, settling at 66.54 EUR/tonne.

Please contact hello@gleg.co.uk for a more detailed market analysis and expert view on how to navigate your energy procurement strategy through the current market volatility.