UK Energy Market Summary to Friday 21st June 2024

Closing prices 21.06.2024

On Monday, short-term gas prices in Britain dropped because of decreased demand and milder weather. Consequently, the NBP spot price fell by more than 2%, closing at 2.8 p/kWh. Additionally, the gas price for delivery in Winter 2024 declined by 2%, reaching 3.4 p/kWh amid a comfortable LNG outlook.

British near-term gas prices gained ground on Wednesday, with the NBP spot price rising by around 2% to 2.9 p/kWh, driven by increasing cooling demand. This rise occurred despite the full return of Nyhamna from an unplanned outage on Tuesday, which stabilized Norwegian supply. Along the forward market, the gas price for Winter 2024 delivery similarly climbed by about 2% to 3.5 p/kWh, influenced by supply concerns and a bullish LNG market.

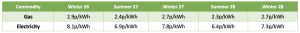

At time of writing, European gas storage levels are 75% full, with the UK 44% full. 2023/24 European gas storage levels have ended Winter 23 at record levels. Over the past week gas has accounted for 26% of the UK generation mix with wind accounting for 17%, solar 12% and nuclear accounting for 18%. Below summarises curve prices as at close of business on Friday.

Curve UK Gas & Electricity Markets

Other Energy Markets

Oil prices surged to their highest closing levels in over a month as investors became more optimistic about the demand outlook. Hence, Brent crude rose by 2% to settle at $84.25 a barrel, while WTI crude reached $80.33, increasing by 2.4% day-on-day.

European carbon prices saw a significant rise on Wednesday following the expiration of the June options contract. This increase was driven by profit-taking, which helped to offset some of the speculative bullish sentiment related to the upcoming elections. As a result, the EUA expiring in December 24 climbed by about 3%, reaching 70.33 EUR/tonne.

Please contact hello@gleg.co.uk for a more detailed market analysis and expert view on how to navigate your energy procurement strategy through the current market volatility.