GLEG UK Energy Market Update…

February 10, 2025

Prices Surge Amid Rising Tariffs and Storage Concerns

February 13, 2025

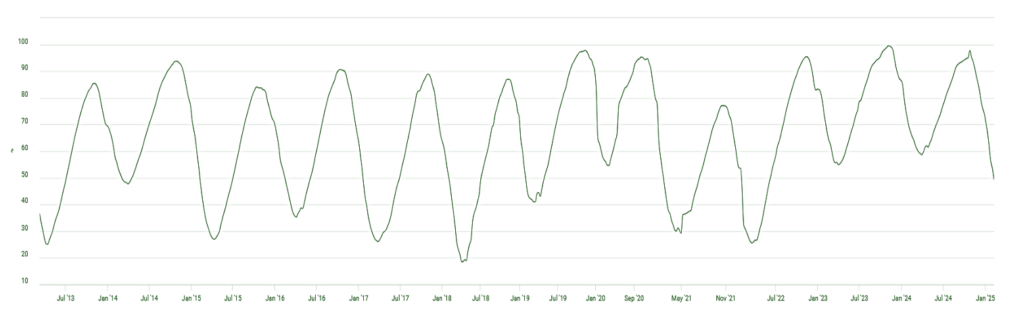

European gas markets have seen a sharp rise in prices as storage withdrawals accelerate, pushing levels below 50%—a figure that now falls beneath the five-year average. With winter demand persisting and geopolitical uncertainties influencing the supply outlook, the market has responded with heightened volatility. However, the scale of the reaction suggests sentiment may be overstated, amplifying price movements beyond fundamental drivers.

Germany, the region’s largest consumer, is moving to secure LNG cargoes throughout the summer, even at elevated prices, in an attempt to fill storage levels promptly. Yet, the potential for additional tariffs—particularly those imposed by the U.S. poses a risk of further price escalation. Russian gas flows via Ukraine remain muted, adding another layer of uncertainty. Despite this, discussions around alternative imports and Europe’s ongoing expansion of LNG infrastructure suggest a growing resilience in the region’s energy strategy.

While current storage levels are below the five-year average, they remain above those seen in 2021 and 2022. In a broader outlook, storage levels at this point would remain within the average rate for the time of year and wouldn’t have resulted in a Bullish drive. Market behaviour, therefore, may be reacting more to recent disruptions than to a fundamental crisis in supply.

Given these factors, concerns over the reduced supply capacity may be overstated. Europe is actively pursuing solutions, whether through expanded LNG imports, new pipeline agreements, or even a limited resumption of Russian flows. While the latter is unlikely to match pre-crisis volumes, a combination of supply sources could mitigate worst-case scenarios.

Looking ahead, the market remains volatile. There are fundamental concerns, despite this however, it is better to remain pre-emptive opposed to reactive. As negotiations progress and infrastructure continues to expand, supply risks could ease. Staying informed and maintaining a balanced perspective will be key in navigating the months ahead. If you’re seeking deeper insights into market movements, our team is always available to provide clarity and guidance.