Low European Storage: Factor or Fear?

February 11, 2025

Navigating the Future of Offshore Wind: Policy and Sustainability

February 14, 2025

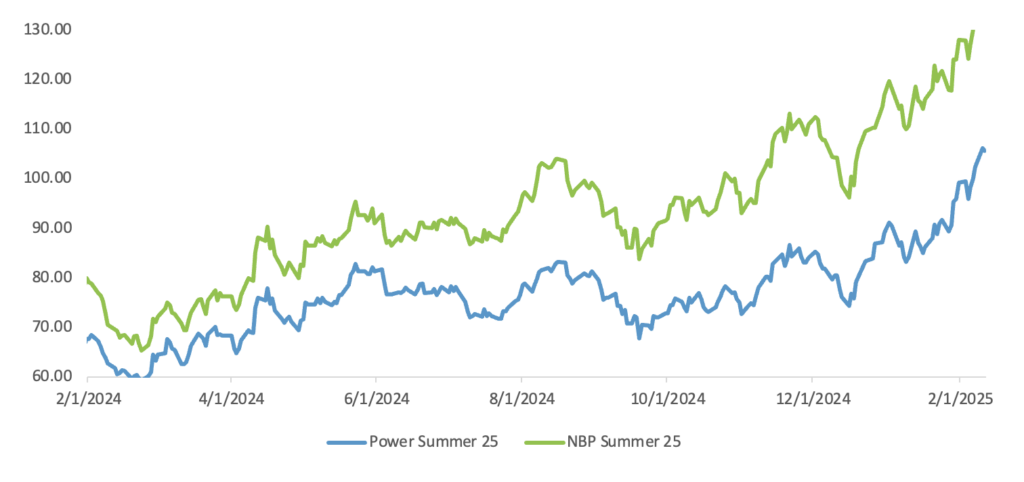

In the last week, energy markets have reacted sharply, with prices surging as front-season contracts saw notable gains. Since February 3rd, power for Winter 2025 has climbed 10%, reaching 10.8p/kWh, while gas for Winter 2025 has risen to 4.5p/kWh. The price rally reflects mounting concerns over supply security, policy developments, and broader market sentiment.

The latest increase in energy costs has been largely driven by discussions around potential levies on LNG injections into European storage have particularly contributed to price volatility, as traders and buyers factor in the risk of increased costs in future procurement strategies. While no definitive policy has been enacted, the uncertainty surrounding regulatory developments has fuelled market speculation, prompting increased hedging activity and upward pressure on prices. Additionally, market participants have highlighted storage levels as a key driver of price movements, with renewed efforts to secure volumes ahead of the next winter season.

However, the current price trajectory remains speculative as negotiations continue. European authorities are reportedly considering lowering the 90% gas storage target initially set for November. If confirmed, this could reduce the urgency of refilling storage levels and potentially moderate the sharp price increases seen in recent weeks. Yet, uncertainties around geopolitical risks and energy policies continue to cloud the outlook.

Overall, speculative concerns are fuelling price volatility. The increase in 2025 prices may be overinflated and short lived. On the other hand, further-dated contracts could remain elevated. With the uncertain geopolitical shifts regarding tariffs, markets may be entering a new phase of sustained volatility. Businesses are advised to monitor developments closely and explore long-term risk management strategies to navigate continued uncertainty.