🔋 Britain Set for a Secure Energy Winter: Positive Outlook from NESO

June 18, 2025

UK Government Unveils Major Reforms to Cut Business Energy Costs

June 23, 2025UK Energy Market Summary to Friday 20th June 2025

Closing prices 20.06.2025

The British spot gas price rose steadily last week, hitting 98.00 p/th on Thursday—an 11-week high—amid reduced Norwegian flows and escalating Middle East tensions. The Winter 2025 contract gained 6.3% to 110.50 p/th, as traders priced in potential LNG disruptions and sustained geopolitical risk.

Spot power prices in Europe were volatile. German and French prices surged over 50% on Thursday due to weaker wind forecasts and unplanned nuclear outages. Forward contracts tracked firmer gas, with modest gains across both markets.

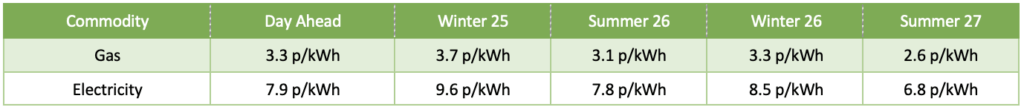

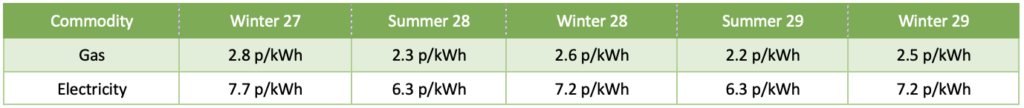

At time of writing, European gas storage levels are 55.81% full, with the UK 23.58% full. European gas storage levels are trending just below the 5-year average throughout 2024. Over the past week gas has accounted for 21.4% of the UK generation mix with wind accounting for 27.3%, solar 13.3% and nuclear accounting for 16.9%. Below summarises curve prices as at close of business on Friday.

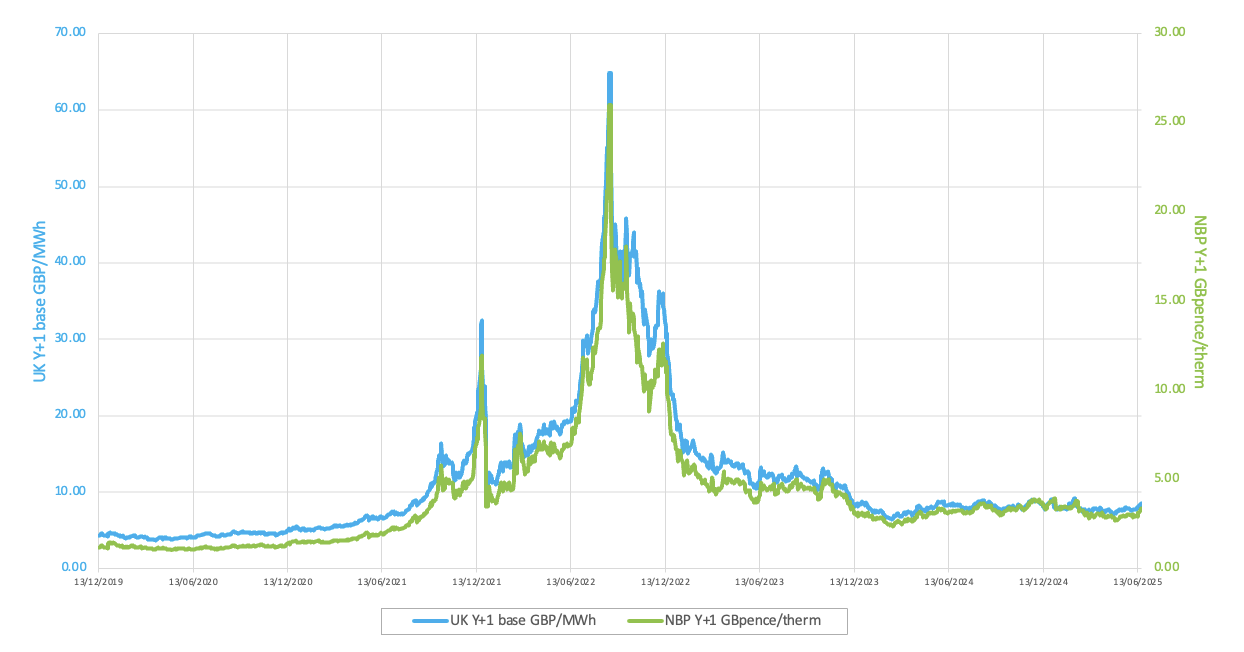

Curve UK Gas & Electricity Markets

Other Energy Markets

Crude prices climbed on fears of supply disruption through the Strait of Hormuz. Brent crude rose 4.4% on Tuesday and closed the week at $78.85/bbl, while WTI settled at $75.60/bbl. Concerns over Iran’s output and possible U.S. intervention supported the rally.

EU carbon prices eased, with Dec-2025 EUAs falling 2.5% to 72.74 EUR/tonne. Selling pressure and position unwinding ahead of the June expiry outweighed earlier gains driven by nuclear sector news.