Storage Fear or Confidence for Winter 2025

August 14, 2025

US & Russia: How Does It Effect Energy Markets…

August 19, 2025UK Energy Market Summary to Friday 15th August 2025

Closing prices 15.08.2025

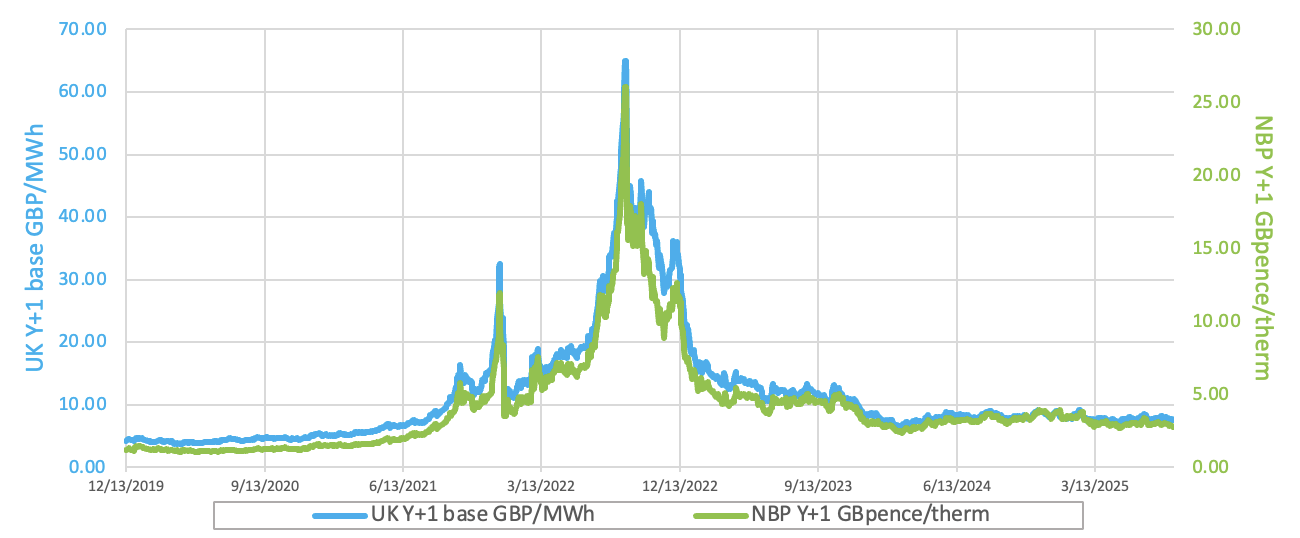

The NBP spot price increased by 1% to 2.7p/kWh on Wednesday, amid soaring European temperatures and prolonged nuclear shutdowns in France. On the forward curve, the Winter 2025 delivery contract gained 0.4% to 3.0 p/kWh due to speculation over potential impacts on the gas sector ahead of an upcoming US–Russia meeting.

British near-term gas prices ended lower on Thursday, the NBP spot price decreased by 2.7% to 2.7 p/kWh. Further out the curve, the Winter 2025 delivery contract traded 1.5% lower at 3.0 p/kWh due to strong supply outlook. European spot electricity prices plunged on Thursday, pressured by stronger wind output.

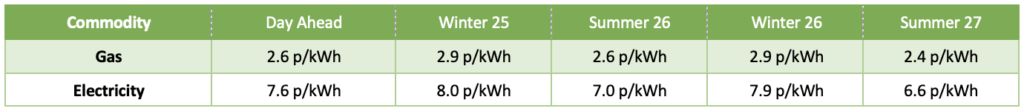

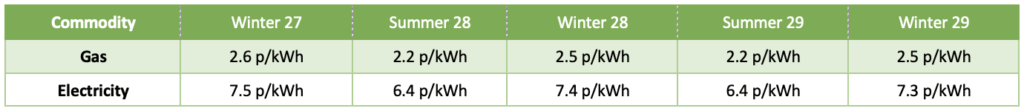

At time of writing, European gas storage levels are 74% full, with the UK 46% full. European gas storage levels are trending on the 5-year average compared to 2024. Over the past week gas has accounted for 33% of the UK generation mix with wind accounting for 15%, solar 11% and nuclear accounting for 11%. Below summarises curve prices as at close of business on Friday.

Curve UK Gas & Electricity Markets

Other Energy Markets

Uncertainty surrounding potential U.S. sanctions on Russia pushed crude oil prices down to an eight-week low on Wednesday. Brent crude traded over 1% lower to $66.89 per barrel. Meanwhile, WTI crude fell by 1.2% to $64.35 per barrel.

European carbon prices rose modestly on Wednesday, supported by weekly ICE data showing investment funds boosted their net long positions, sparking a short-term EUA rally.