ESOS Phase 3 – Annual Action Plan Updates Due December 2025

August 29, 2025

⚡ Ofgem’s Update on TNUoS Charges – What It Means for Electricity Contracts

September 4, 2025UK Energy Market Summary to Friday 29th August 2025

Closing prices 29.08.2025

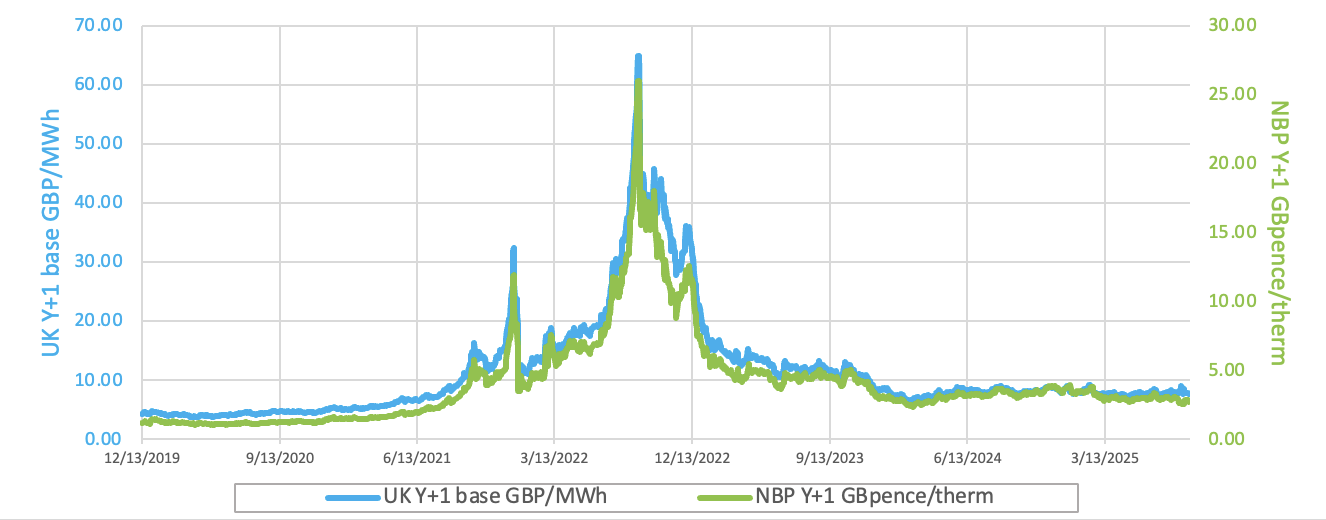

Ample LNG arrivals pushed British near-term gas prices lower on Wednesday, with the NBP spot price dipping by 2.5% to 2.8 p/kWh. On the forward curve, the Winter 2025 delivery contract slumped by 2.6% to 2.9 p/kWh, as gas storage sites advanced toward EU target levels.

Speculation over softer US sanctions pressured British near-term gas prices on Thursday, with the NBP spot price dipping by nearly 4% to 2.7 p/kWh after the first delivery of Russian LNG from a sanctioned project, potentially boosting global supply. On the forward curve, muted Asian demand, continues to redirect LNG cargoes to Europe. As a result, the Winter 2025 delivery contract dropped by 2.3% to 2.9 p/kWh.

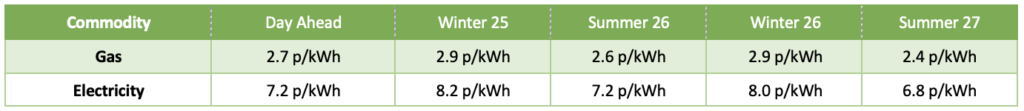

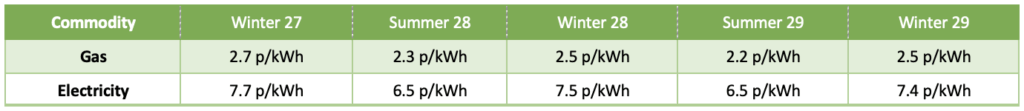

At time of writing, European gas storage levels are 77% full, with the UK 44% full. European gas storage levels are trending on the 5-year average compared to 2024. Over the past week gas has accounted for 21% of the UK generation mix with wind accounting for 40%, solar 10% and nuclear accounting for 12%. Below summarises curve prices as at close of business on Friday.

Curve UK Gas & Electricity Markets

Other Energy Markets

Crude oil prices bounced back on Wednesday after the prior session’s sharp drop, lifted by renewed geopolitical friction and a smaller-than-expected U.S. stock draw. The U.S. raised tariffs on Indian imports by 25%.

European carbon prices eased on Wednesday, dragged lower by weakening gas markets and persistent softness in Asia, with fundamentals offering limited support.