GLEG UK Energy Market Update…

September 15, 2025

Strengthening the UK’s Energy Security: A New Storage Facility in the Irish Sea

September 26, 2025UK Energy Market Summary to Friday 19th September 2025

Closing prices 19.09.2025

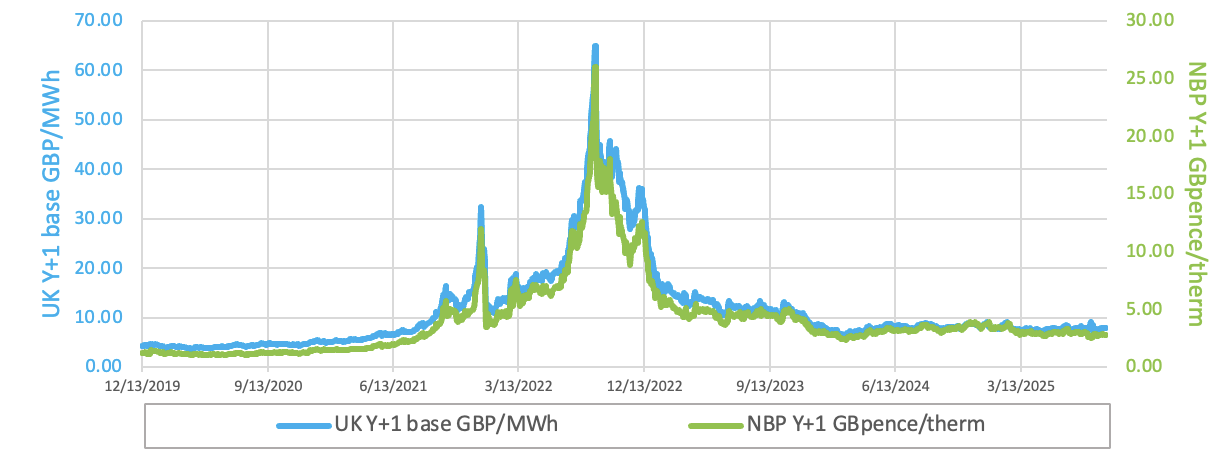

An increase in MRS injections supported the NBP spot price, which edged 0.3% higher to 2.7 p/kWh on Wednesday, despite the UK securing a second LNG cargo for September 2025 delivery. On the forward curve, the Winter 2025 delivery contract was little changed at around 2.9 p/kWh, as continued storage replenishment ahead of winter underpinned prices, while comfortable LNG stocks at 60% limited further upside.

Unplanned outages at Norway’s Troll and Kollsnes fields lifted the NBP spot price, which soared by 2.6% to 2.8 p/kWh on Thursday. Forecasts of a sharp UK temperature drop to 10°C early next week, signalling the start of the heating season, also lent support to prices.

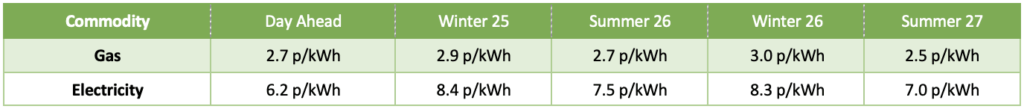

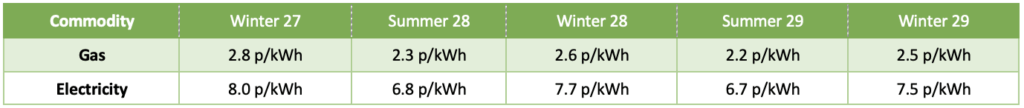

At time of writing, European gas storage levels are 81% full, with the UK 47% full. European gas storage levels are trending on the 5-year average compared to 2024. Over the past week gas has accounted for 17% of the UK generation mix with wind accounting for 50%, solar 6% and nuclear accounting for 8.7%. Below summarises curve prices as at close of business on Friday.

Curve UK Gas & Electricity Markets

Other Energy Markets

Crude oil prices extended losses on Thursday, pressured by worries over US fuel demand despite the Federal Reserve’s 25-basis-point rate cut. Traders noted that the rate move was largely anticipated and already reflected in markets, limiting its impact.

European carbon prices firmed on Thursday, rebounding from the prior session’s sell-off and edging toward a key technical level.