World To Tender More Than 100GW Of Renewable In 2024

March 14, 2024Britain’s National Grid Proposes $74 Billion Energy System Upgrade

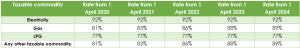

March 20, 2024The climate change levy rates are changing which may mean your business needs to complete new PP10-11 form for your supplier and for HMRC. Below summarises the new rates from 01.04.2024…

What is the Climate Change Levy?

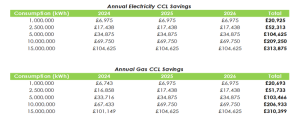

The Climate Change Levy is a tax on the amount of energy a business consumes, the tax is usually at the bottom of an invoice, split out separately to other charges making it simple to calculate your CCL cost. Businesses with certain qualifying processes are entitled to up to a 92% discount on electricity CCL charges and an 89% discount on gas CCL charges which for large businesses is a significant saving on invoices. The below table summarises typical annual and three-year savings based on different energy consumptions.

How can we help?

With energy commodity prices increasing significantly compared to pre-covid levels. a tangible and clear saving on your business energy bill is well worth exploring. Here at GLEG we offer a fully delivered management service to maximise CCL savings and minimise your time to deliver this. The scheme is likely to re-open for new applicants later this year.

Our experts complete an initial eligibility assessment, completing and submitting the application form on your behalf to obtain the savings. All the administrative burden is then managed on your behalf including an evidence pack to prove eligibility if audited and monitoring performance to ensure your savings are maximised through the scheme. All eligible sites will realise the CCL savings on invoices until at least 2027.

To understand whether your business is eligible for these savings please contact hello@gleg.co.uk.