Proposals For 840MW Solar Facility In The UK

November 19, 2024COP29-Final Round Up…

November 22, 2024

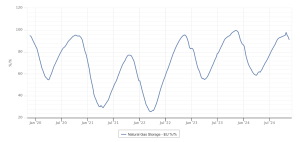

Recent pressures have prompted notable shifts in the market as European storage withdrawals increase, coinciding with a decline in renewable energy output and temperatures settling below seasonal averages.

The rise in gas demand has resulted in storage levels falling below the averages of the past two years. It is important to highlight that the last two winters were relatively mild, which contributed to a confident supply outlook.

Market participants are currently assessing concerns regarding potential restrictions on Russian gas supplies to Europe, as well as increasing competition from Asia. Nevertheless, LNG injections remain robust, with nine LNG cargoes scheduled for the UK in the coming weeks.

Despite these challenges, storage levels are currently around 89%, significantly higher than those in 2021 when market sentiment was affected by scarcity. This stability indicates a positive outlook for storage capacity, with particular attention on remaining supplies by the close of March 2025.

In recent years, Europe experienced a surplus of LNG, leading to additional supplies being injected into storage in Ukraine, while several LNG cargoes were retained as floating storage. This scenario contrasts with current market conditions. In summary, the ongoing trend of reductions will significantly influence market prices, with storage levels remaining within a supportive range for now.