GLEG Energy Market Update…

September 9, 2024

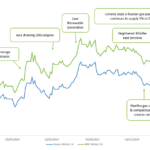

Market Momentum Takes Downward Turn…

September 12, 2024

Energy costs have become a major expense for businesses over the past four years. Some consumers are locked into long-term contracts at much higher rates due to unpredictable market changes, especially with Europe’s shift from Russian gas to LNG. This volatility isn’t likely to ease anytime soon.

Flexible procurement gives businesses more control over energy costs. A big chunk of the energy bill (40-60%) comes from wholesale commodity prices. By using flexible purchasing, businesses can take advantage of market opportunities, buying energy at strategic times instead of being stuck with high rates due to shortages.

With flexible purchasing, you can buy energy when prices are favorable, and you’ll get regular updates from the trading team to keep you informed. You can also set budgets in advance, so there’s still financial certainty.

Fixed contracts often include risk margins due to market volatility, but flexible contracts let you take advantage of live market prices, which usually lowers costs.

GLEG offers tools to track projected costs with automated weekly updates or on-demand access via a portal. This flexibility helps avoid inflated prices by buying directly at market value, and businesses can even leave some volume to the day-ahead market, which has saved about 23% over the past year.

Lastly, the option to purchase in smaller increments adds even more flexibility, making it easier for businesses of all sizes to manage their energy costs efficiently.