Utility Management in 2021

January 11, 2021How the UK electricity generation mix is changing

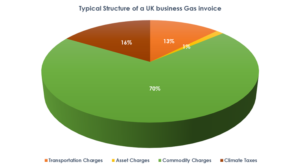

January 29, 2021UK business gas invoices are much simpler in terms of structure than your typical business electricity invoice. The chart below highlights the split of a typical business gas invoice. With the commodity making up such a large percentage of the invoice a pro-active gas purchasing strategy is essential to minimise gas charges.

Commodity – The raw cost of gas. Your price is determined by how and when your businesses purchase gas on the wholesale market. Gas commodities fluctuate daily, your total gas bill is largely influenced by how you purchase your commodity simply because there are not as many other charges in your gas invoices as there are in your electricity invoice.

Unidentified Gas – As gas travels along the networks from the producer to the customer meter there occurs a natural inefficiency whereby gas is lost along the route. As a result, this gas will never be ‘metered’ and paid for unless an assumption of the rate of losses is made and this ‘unbilled volume’ is added to the final price.

Transportation– Gas must be transported through our gas network from source to end user through distribution and transmission networks. Suppliers pay regional distribution networks for their services; these regional distribution networks publish tariffs which allow suppliers to accurately quote rates for you.

Asset Charges – This is the cost to cover the cost of maintaining your gas meter.

Green Taxes – The climate change levy on gas will increase to 0.465p/kWh from 1st April 2021 meaning the tax has more than doubled since 2019.

The climate change levy is a tax which most business can see a reduction on, it now accounts for approximately 25% of a typical business gas invoice.

Please contact hello@gleg.co.uk for further details or any queries on your gas invoice.