BP’s Strategic Shift: What It Means for Sustainable Energy…

February 27, 2025

Trump and Zelenskyy’s Meeting Raises Market Uncertainty…

March 3, 2025UK Energy Market Summary to Friday 28th February 2025

Closing prices 28.02.2025

British spot gas prices experienced a decline on Wednesday, influenced by higher renewable energy output and lower demand due to warmer-than-average weather. Thus, NBP spot dropped over 5.4%, settling just above 3.4 p/kWh. In further developments, the Summer 2025 delivery contract plummeted by 6.6%, closing at 3.4 p/kWh.

British spot gas price surged on Thursday, driven by lower renewables output and higher demand. Thus, NBP spot jumped by over 9%, settling at 3.7 p/kWh. Further along the curve, the Summer 2025 delivery contract soared by 8.4% to 3.7 p/kWh, as price parity with Asia heightened competition for LNG shipments.

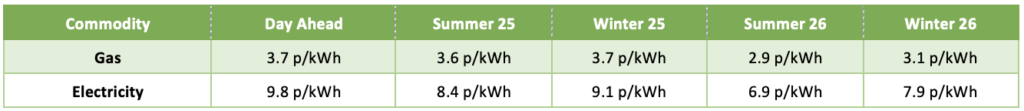

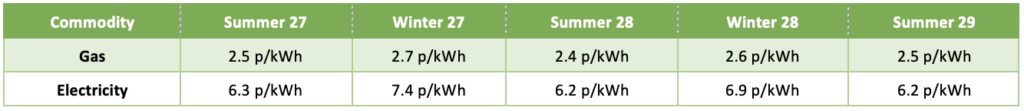

At time of writing, European gas storage levels are 38% full, with the UK 22% full. European gas storage levels are trending just below the 5-year average throughout 2024. Over the past week gas has accounted for 35% of the UK generation mix with wind accounting for 26%, solar 5% and nuclear accounting for 13%. Below summarises curve prices as at close of business on Friday.

Curve UK Gas & Electricity Markets

Other Energy Markets

U.S. President Donald Trump revoked Chevron’s licence to operate in Venezuela, driving crude oil prices higher on Thursday. Brent crude rose by over 2% to slightly above $72 per barrel.

On Thursday, European carbon prices strengthened, tracking a technical spike in natural gas prices. As a result, EUAs expiring in Dec-2025 increased by 2.5%, settling at 72.78 EUR/tonne, recovering from recent lows.