Strong Growth in Electric Vehicle Sales Boosts Momentum Toward a Greener Future

July 10, 2025

Europe’s Energy Market: How Surging Solar Output Is Driving Prices Negative

July 15, 2025UK Energy Market Summary to Friday 11th July 2025

Closing prices 11.07.2025

The British spot gas price rose marginally to 2.8p/kWh on Wednesday, as persistent cooling demand amid high temperatures offset generally steady supply conditions. On the forward curve, the Winter 2025 delivery contract gained 0.4% to 3.2 p/kWh, as LNG shipments continued to bypass the Suez Canal.

The British spot gas price soared by 2.3% to a two-week high of 2.9 p/kWh on Thursday, as a looming heatwave and stronger Asian LNG demand raised supply concerns. UK temperatures are expected to rise 5–6°C above average. On the forward curve, the Winter 2025 delivery contract increased by 1.7% to 3.2 p/kWh, supported by persistent geopolitical tensions.

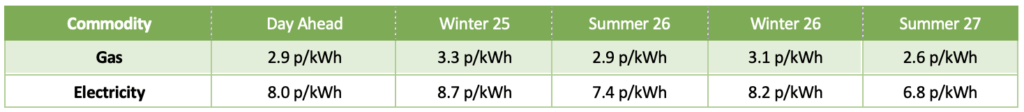

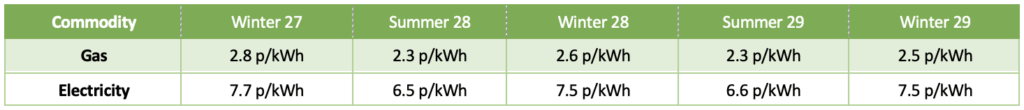

At time of writing, European gas storage levels are 62% full, with the UK 28% full. European gas storage levels are trending just below the 5-year average throughout 2024. Over the past week gas has accounted for 25% of the UK generation mix with wind accounting for 18%, solar 16% and nuclear accounting for 15%. Below summarises curve prices as at close of business on Friday.

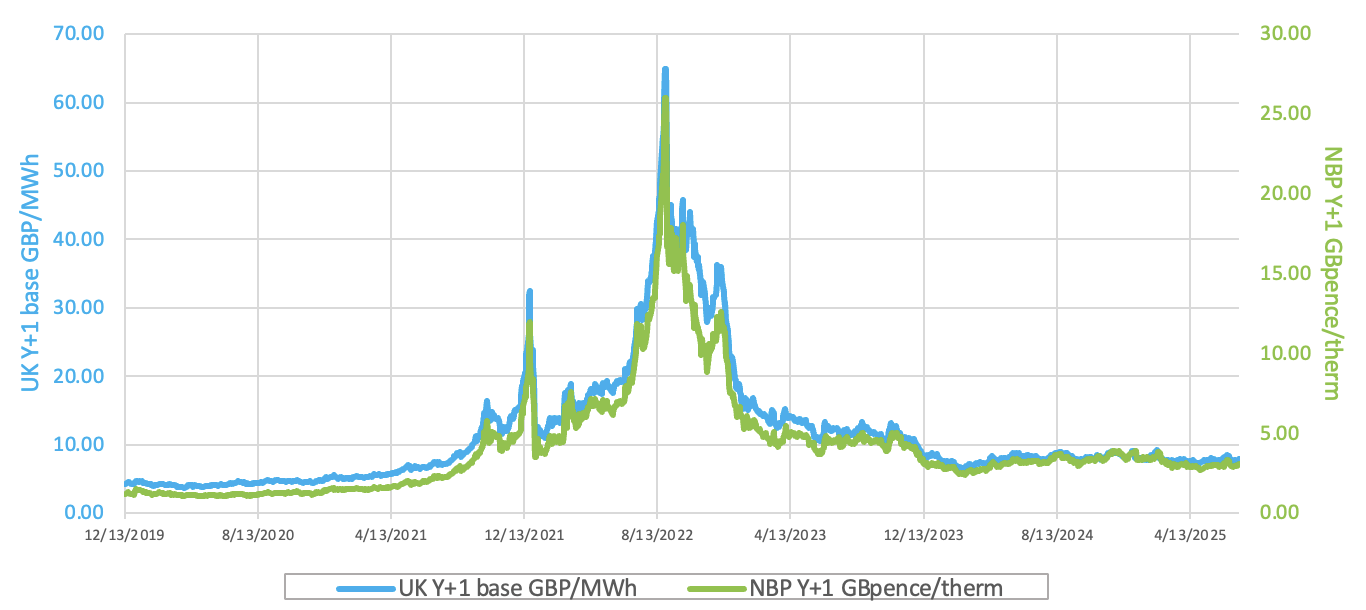

Curve UK Gas & Electricity Markets

Other Energy Markets

Crude oil prices remained steady to slightly higher on Wednesday as market participants weighed robust U.S. gasoline demand and renewed attacks on shipping in the Red Sea against an unexpected increase in U.S. crude inventories.

Despite hotter weather forecasted across western Europe, European carbon prices slipped on Wednesday, weighed by subdued supply-demand dynamics. Consequently, EUAs expiring in Dec-2025 edged lower at 70.39 EUR/tonne.