🇬🇧 UK Reforms CfD Scheme: Renewable Energy Contracts Extended to 20 Years

July 18, 2025

🌍 Important Updates to the UK’s Climate Change Agreements (CCA) Scheme

July 22, 2025UK Energy Market Summary to Friday 18th July 2025

Closing prices 18.07.2025

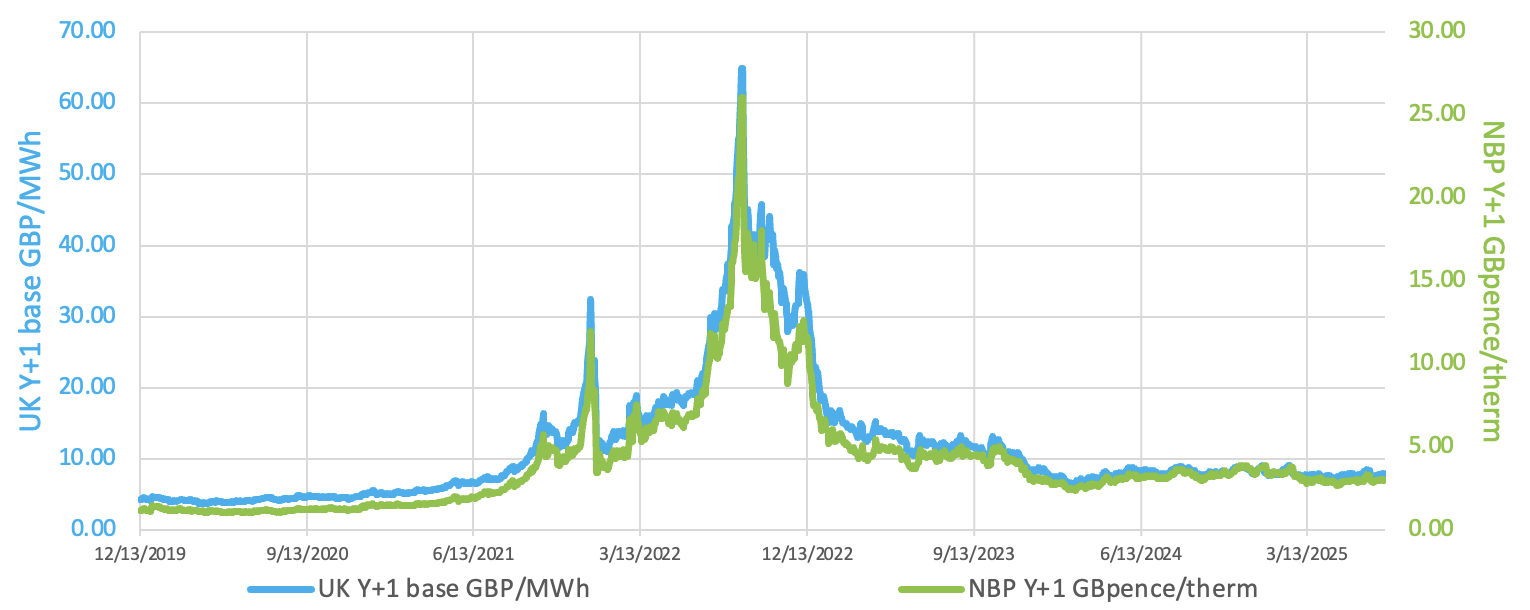

The Winter 2025 delivery contract edged 0.2% higher at 3.2 p/kWh, amid raised concerns over potential LNG supply constraints in Europe due to Asian heatwave, though the overall risk remained limited.

The NBP spot price soared by 2.3% to 2.9 p/kWh on Thursday, following unplanned outages at the Nyhamna and Kollsnes plants, which together reduced supply by 101 mcm/d. Further along the curve, the Winter 2025 delivery contract dropped by 1.2% to 3.2 p/kWh, as geopolitical risks eased following the EU’s failure to approve new sanctions on Russia, with Slovakia seeking exemptions from the gas phase-out by 2028.

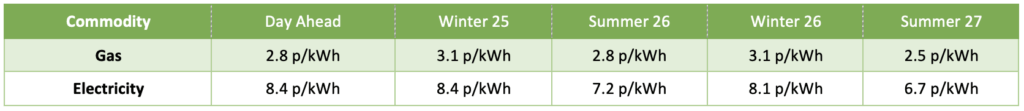

At time of writing, European gas storage levels are 65% full, with the UK 29% full. European gas storage levels are trending just below the 5-year average throughout 2024. Over the past week gas has accounted for 26% of the UK generation mix with wind accounting for 22%, solar 10% and nuclear accounting for 16%. Below summarises curve prices as at close of business on Friday.

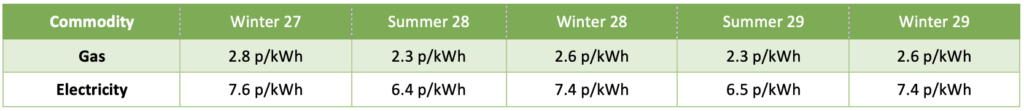

Curve UK Gas & Electricity Markets

Other Energy Markets

Crude oil prices fell marginally on Wednesday, weighed by a surprise build in U.S. fuel stocks and tariff-related economic concerns. Gasoline inventories rose by 3.4 million barrels and distillates by 4.2 million, both far above forecasts.

European carbon prices dropped on Thursday, with profit-taking outweighing support from a draft EU plan to reconnect the EU and UK emissions trading schemes.