October Energy Contracts: Strategic Timing for Smart Procurement

August 22, 2025

Ofgem Announces 2% Energy Price Cap Rise

August 27, 2025UK Energy Market Summary to Friday 22nd August 2025

Closing prices 22.08.2025

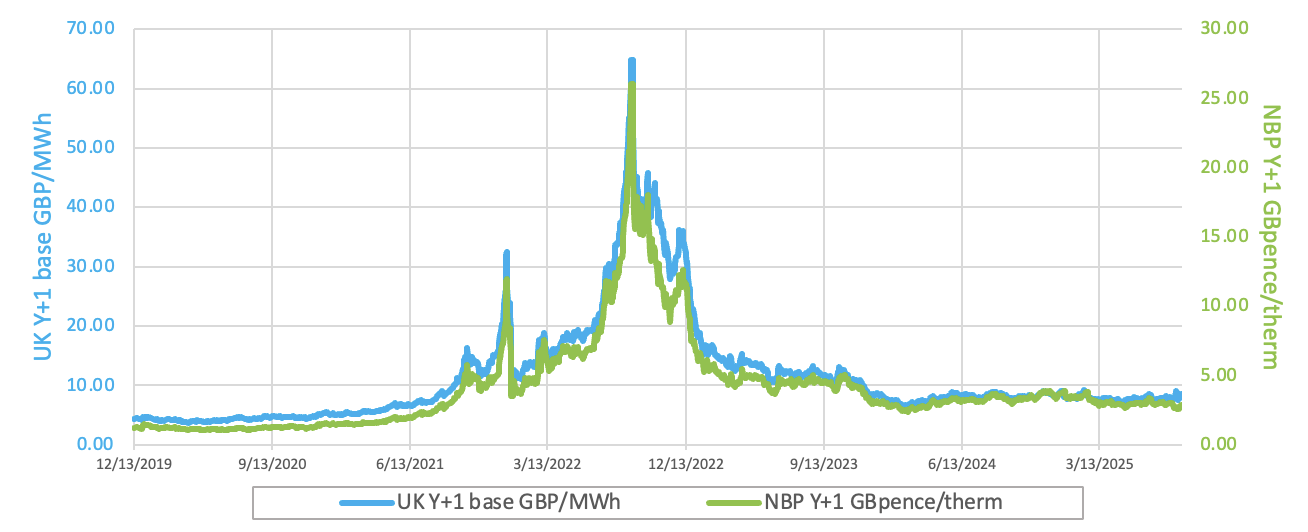

British near-term gas strengthened on Thursday, with the NBP spot price climbing by over 3% to 2.8 p/kWh. Support came from the lack of LNG deliveries, scheduled Norwegian maintenance, and fresh Russian strikes on Ukrainian gas infrastructure. On the forward curve, sustained demand to replenish storage ahead of the heating season pushed the Winter 2025 delivery contract up by 3.3% to 3.0 p/kWh.

Stronger demand and reduced Norwegian supply lent support to British near-term gas on Friday, with the NBP spot price rising by 1.3% to 2.9 p/kWh. On the forward curve, fading Russia-Ukraine peace prospects pushed the Winter 2025 delivery contract up by 0.8% to 3.1 p/kWh, following Russia’s attack on a key Ukrainian compressor station.

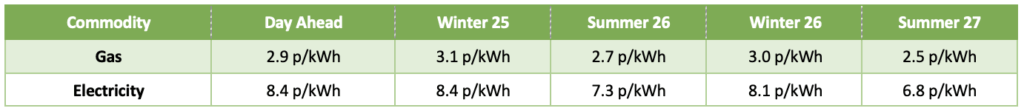

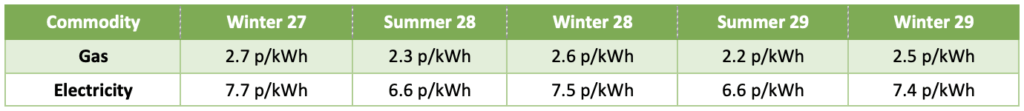

At time of writing, European gas storage levels are 76% full, with the UK 46% full. European gas storage levels are trending on the 5-year average compared to 2024. Over the past week gas has accounted for 31% of the UK generation mix with wind accounting for 19%, solar 10% and nuclear accounting for 11%. Below summarises curve prices as at close of business on Friday.

Curve UK Gas & Electricity Markets

Other Energy Markets

Uncertainty surrounding potential U.S. sanctions on Russia pushed crude oil prices down to an eight-week low on Wednesday. Brent crude traded over 1% lower to $66.89 per barrel. Meanwhile, WTI crude fell by 1.2% to $64.35 per barrel.

European carbon prices firmed on Thursday, supported by strength in the wider energy complex and a tilt toward mildly bullish technical signals.