Rethinking Constraint Costs in the UK Energy System

September 11, 2025

GLEG UK Energy Market Update…

September 22, 2025UK Energy Market Summary to Friday 12th September 2025

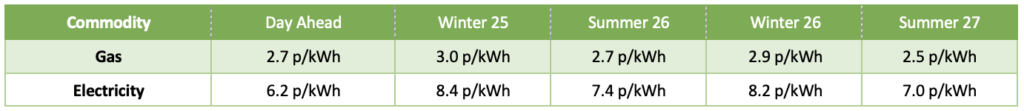

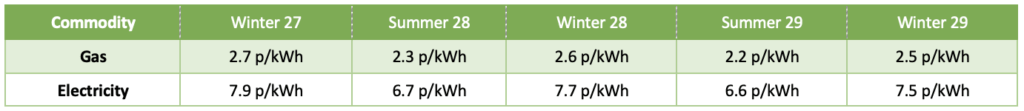

Closing prices 12.09.2025

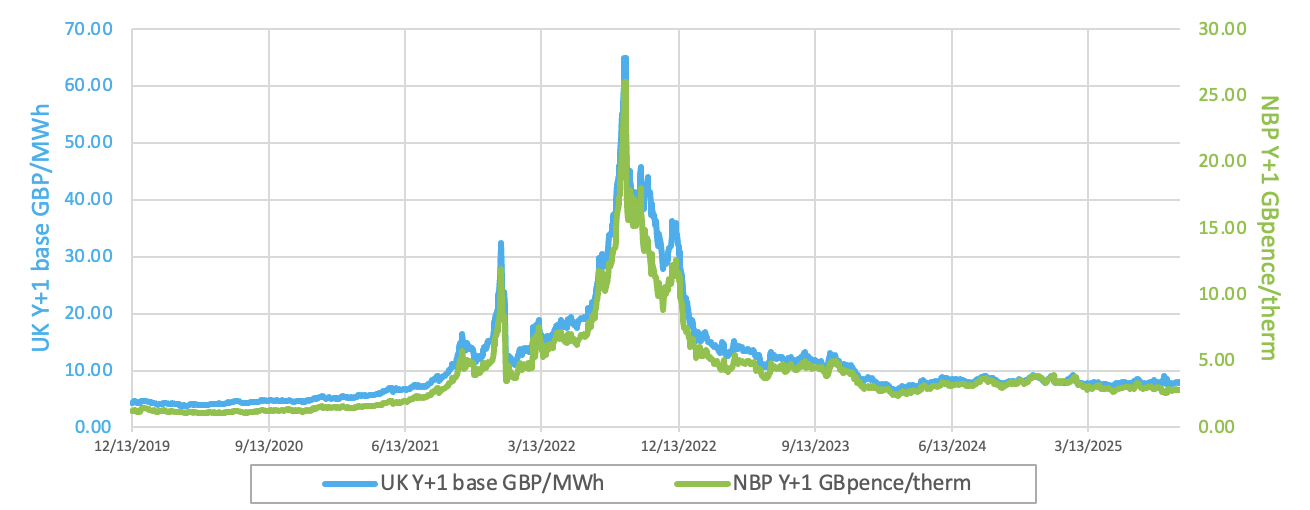

With reduced competition from Asia, the NBP spot price slipped by 0.1% to 2.7 p/kWh on Wednesday, as China increased intake of Russian pipeline gas and Arctic LNG 2 supplies. Further along the curve, the Winter 2025 delivery contract gained 0.3% to 3.0 p/kWh, supported by renewed tensions in the Middle East and the need to replenish European gas inventories, though ample supply limited the upside.

On Thursday further along the curve, the Winter 2025 delivery contract dropped by 2% to 2.9 p/kWh, while Turkey finalized eight deals securing 15 bcm for 2026–2028, aiding the EU’s efforts to diversify gas sources as it phases out Russian imports.

At time of writing, European gas storage levels are 79% full, with the UK 46% full. European gas storage levels are trending on the 5-year average compared to 2024. Over the past week gas has accounted for 18.6% of the UK generation mix with wind accounting for 46%, solar 8% and nuclear accounting for 12%. Below summarises curve prices as at close of business on Friday.

Curve UK Gas & Electricity Markets

Other Energy Markets

Crude oil prices moved downwards on Thursday, as concerns over weakening demand growth and excess supply outweighed geopolitical risks.

Expectations of a tighter market in 2026 lent support to European carbon prices on Wednesday, with compliance buying and speculative positioning pushing the EUAs expiring in Dec-2025.