Global Oil Prices Climb as Sanctions Tighten on Russian Energy Giants

October 23, 2025

GLEG UK Energy Market Update…

November 3, 2025UK Energy Market Summary to Friday 24th October 2025

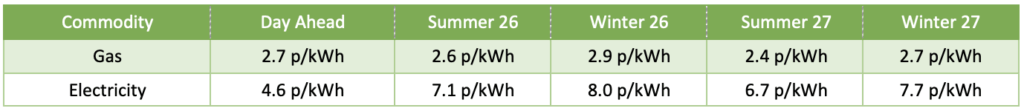

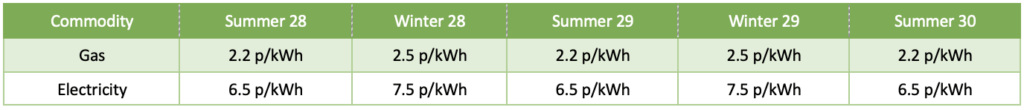

Closing prices 24.10.2025

Strong winds are expected to counteract the colder temperatures over the next few days, while early November should bring milder conditions, keeping heating demand in check. Consequently, the NBP spot fell by 1% to 2.6 p/kWh on Wednesday. On the forward curve, the Summer 2026 delivery contract slipped by 0.2% to 2.6 p/kWh, pressured by ample supply as European LNG inflows remained robust, supported by subdued demand from Asia.

Anticipation of stronger near-term demand lifted the NBP spot price up by 1.8% to 2.7 p/kWh on Thursday. While the remainder of the month is expected to be seasonally mild, some colder days ahead could provide additional support. On the forward curve, the Summer 2026 delivery contract soared by 2% to 2.6 p/kWh, following the EU’s approval of a new sanctions package on Russia, which includes a ban on LNG imports starting in early 2027.

At time of writing, European gas storage levels are 83% full, with the UK 58% full. European gas storage levels are trending around the 5-year average. Over the past week gas has accounted for 18% of the UK generation mix with wind accounting for 53%, solar 4% and nuclear accounting for 12%. Below summarises curve prices as at close of business on Friday.

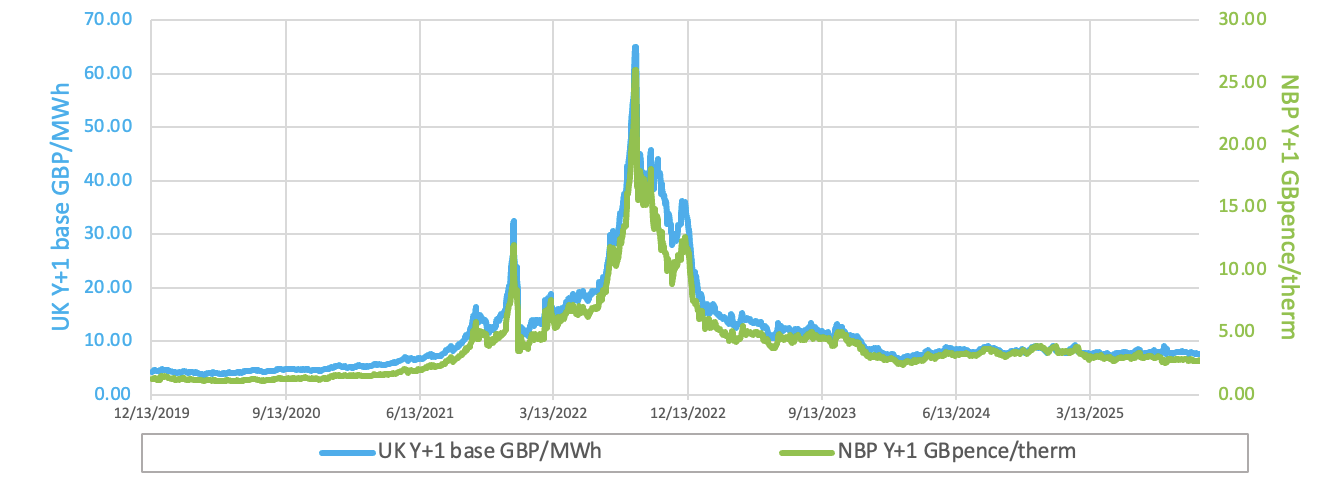

Curve UK Gas & Electricity Markets

Other Energy Markets

Crude oil prices extended gains on Wednesday as the U.S. rolled out Ukraine-related sanctions against Russia, focusing on major oil firms Lukoil and Rosneft. Concerns over supply were heightened after Western nations urged Asian buyers to curb Russian imports and the planned Trump-Putin summit was postponed.

European carbon prices were largely flat on Thursday, with attention focused on the latest U.S. sanctions on Russian oil. Meanwhile, forecasts for mild and windy weather suggested weaker demand for fossil-fuel generation.