GLEG UK Energy Market Update…

October 27, 2025

⚡ UK Government Boosts Support for Energy-Intensive Industries

November 4, 2025UK Energy Market Summary to Friday 31st October 2025

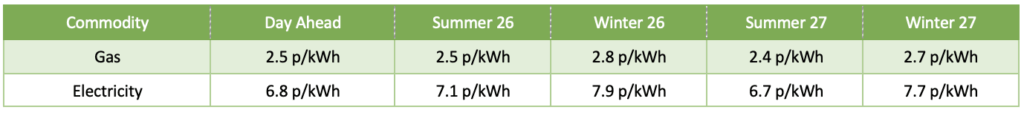

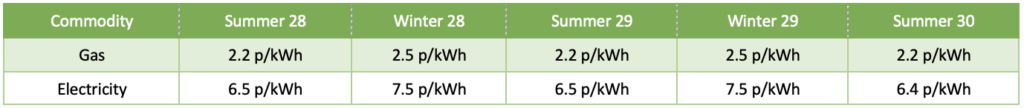

Closing prices 31.10.2025

The British spot gas price rose by 1% to 2.7 p/kWh on Wednesday, driven by limited output from Norway’s Troll gas field due to scheduled maintenance, which cut pipeline deliveries to Europe by roughly 60 mcm/day. On the forward curve, the Summer 2026 delivery contract also added 1% to settle at 2.6 p/kWh, underpinned by rising geopolitical uncertainty following the collapse of the Gaza ceasefire and ahead of upcoming US-China trade discussions.

Stronger Norwegian pipeline flows into Europe weighed on British gas prices on Thursday. The NBP spot price dropped by 6.3% to 2.5 p/kWh, as maintenance at Norway’s Troll field wrapped up early and LDZ demand dropped sharply by 26 mcm/d. On the forward curve, the Summer 2026 delivery contract fell by 1.3% to 2.6 p/kWh, driven by ample LNG keeping supply balanced. European LNG send-out remained near seasonal record levels, around 4,400 GWh/day (396 mcm/day).

At time of writing, European gas storage levels are 83% full, with the UK 58% full. European gas storage levels are trending around the 5-year average. Over the past week gas has accounted for 18% of the UK generation mix with wind accounting for 51%, solar 4% and nuclear accounting for 12%. Below summarises curve prices as at close of business on Friday.

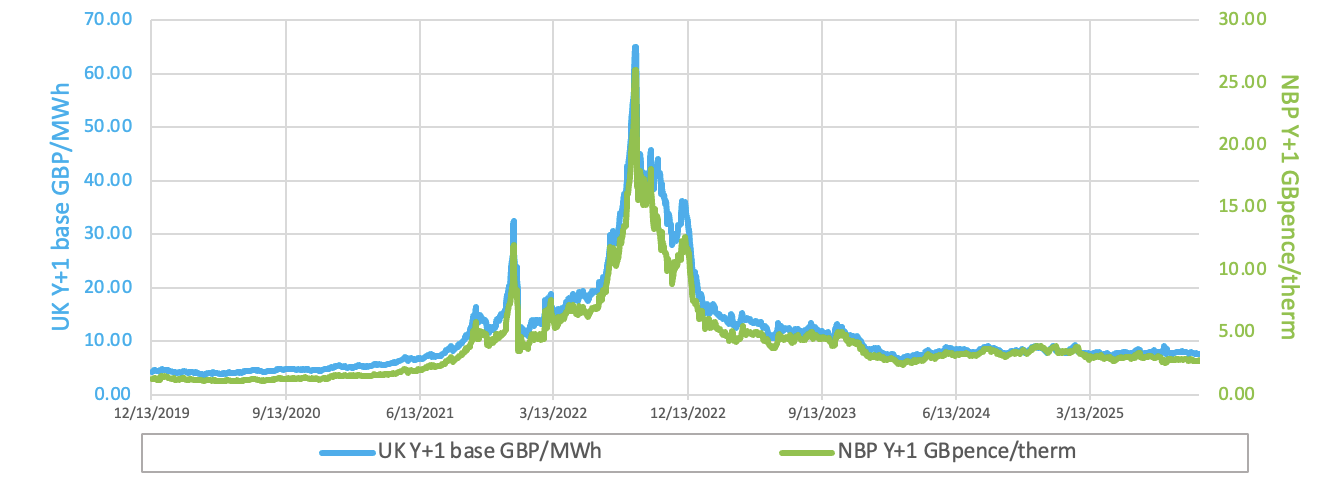

Curve UK Gas & Electricity Markets

Other Energy Markets

Crude oil prices edged higher on Thursday as optimism grew over a possible US-China trade agreement after Presidents Donald Trump and Xi Jinping met in Busan. Trump suggested a deal could be finalized “pretty soon,” although China had not yet responded. Gains were limited, however, as markets awaited this week’s OPEC+ meeting.

European carbon prices eased on Thursday, reversing earlier advances amid wider market weakness. The EUAs expiring in Dec-2025 slipped by 0.2% to 78.67 EUR/tonne.