⚡ UK Government Boosts Support for Energy-Intensive Industries

November 4, 2025

COP30: What It Means for the Energy Transition

November 13, 2025UK Energy Market Summary to Friday 7th November 2025

Closing prices 07.11.2025

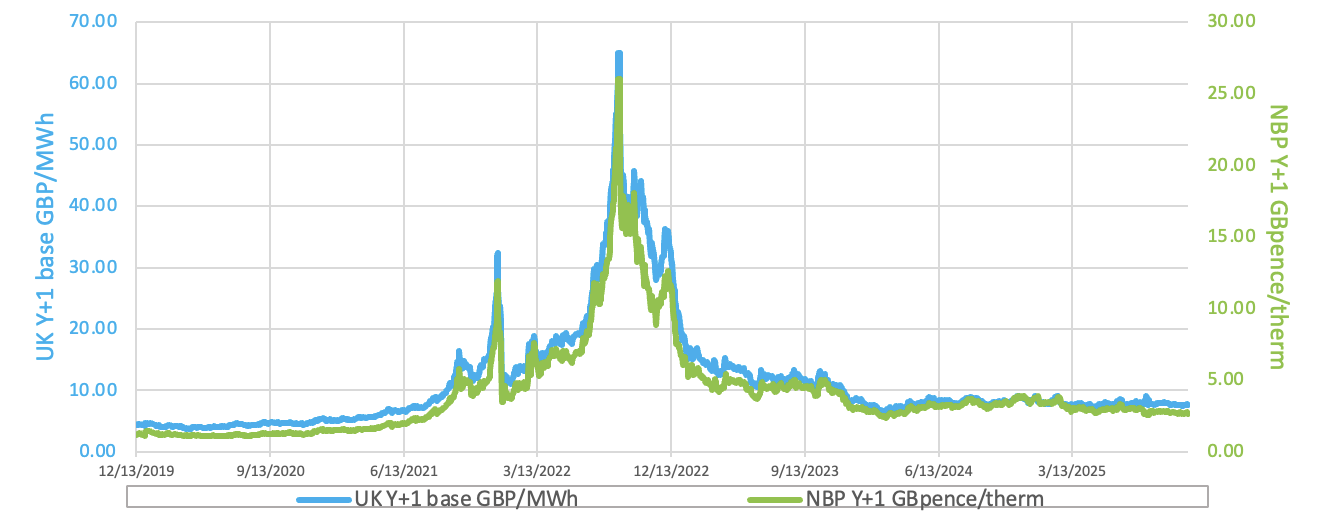

Despite weaker wind output, the NBP spot price dropped by 1.3% to 2.64 p/Kwh on Wednesday, as mild weather kept demand subdued. Ample supply weighed on the forward curve, with the Summer 2026 delivery contract falling by 1.4% to 2.60 p/kWh, as preliminary Kpler data indicated LNG imports to the EU-27 and the UK jumped by 22% in October to a seven-month high of 10.12 million tonnes (13.8 bcm).

Abundant LNG supply, rising Norwegian flows, and warmer temperature forecasts pushed UK gas prices down on Thursday. Hence, the NBP spot price fell by 2.2% to 2.58 p/kWh with the UK securing a ninth November LNG cargo amid soft Asian demand and growing global output. On the forward curve, the Summer 2026 delivery contract declined by 0.7% to 2.58 p/kWh, with storage remaining robust and LNG tanks around 70%, helping to sustain confidence in supply conditions.

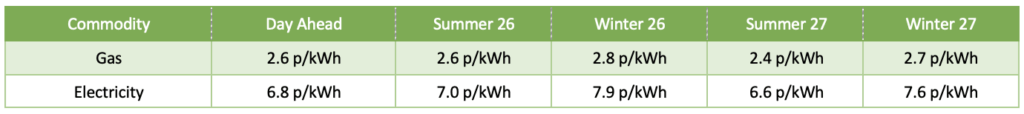

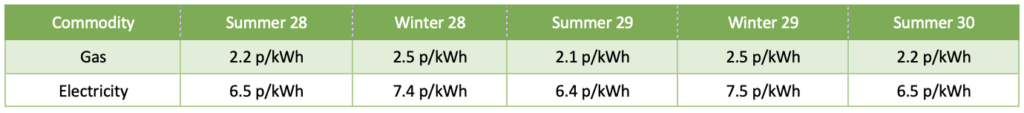

At time of writing, European gas storage levels are 82.6% full, with the UK 63% full. European gas storage levels are trending around the 5-year average. Over the past week gas has accounted for 33% of the UK generation mix with wind accounting for 35%, solar 2% and nuclear accounting for 12%. Below summarises curve prices as at close of business on Friday.

Curve UK Gas & Electricity Markets

Other Energy Markets

Crude oil prices edged lower on Thursday, pressured by concerns of a possible global supply surplus and subdued U.S. demand, as low refinery activity reflected weaker consumption during the maintenance season.

European carbon prices eased on Thursday, weighed by weakness across the broader energy market and bearish positioning among EUA investors. The EUAs expiring in Dec-2025 decreased by 1.6% to 80.17 EUR/tonne.