COP30: What It Means for the Energy Transition

November 13, 2025

If Your Margins Depend on Stable Energy Costs, This Week’s News Matters…

November 18, 2025UK Energy Market Summary to Friday 14th November 2025

Closing prices 14.11.2025

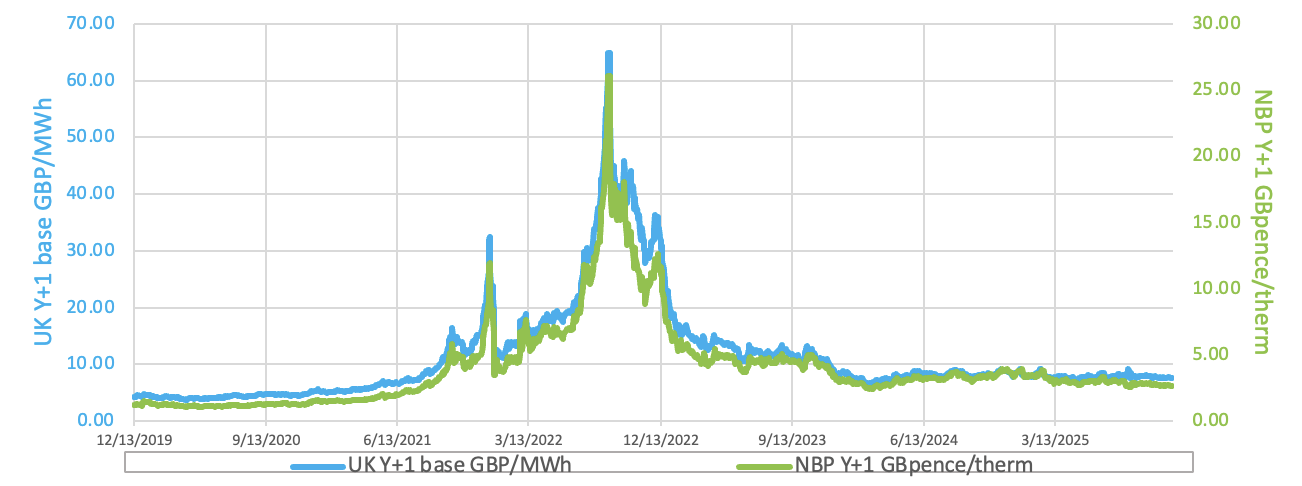

An unplanned outage at Norway’s Karsto gas processing plant pushed UK gas prices higher on Wednesday, with the NBP spot price soaring by 7.8% to 2.3 p/kWh. In contrast, the Summer 2026 delivery contract slipped by 0.4% to 2.5 p/kWh, driven by abundant LNG supply and weak demand in Asia, which helped limit broader market pressures. European spot electricity prices diverged on Wednesday.

The British spot gas price increased by 0.7% to 2.3 p/kWh on Thursday, as colder weather boosted demand, limiting supply by around 9 mcm/day through Friday. Meanwhile, the Summer 2026 delivery contract dropped by 1% to 2.5 p/kWh, weighed by relatively muted Asian demand and strong European LNG flows, which were last reported around 419 mcm/day, roughly 38% higher than the same period last year.

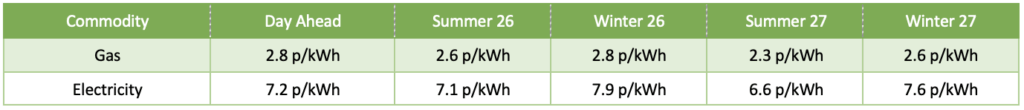

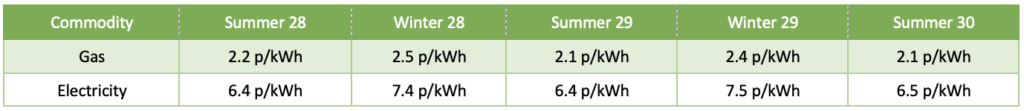

At time of writing, European gas storage levels are 82% full, with the UK 64% full. European gas storage levels are trending around the 5-year average. Over the past week gas has accounted for 31% of the UK generation mix with wind accounting for 41%, solar 1% and nuclear accounting for 9%. Below summarises curve prices as at close of business on Friday.

Curve UK Gas & Electricity Markets

Other Energy Markets

Crude oil prices rebounded on Thursday after U.S. lawmakers ended the country’s longest-ever government shutdown. The House approved a funding bill 222–209 on Wednesday, and President Trump signed it into law, keeping the government funded until at least January 30.

Speculative investors increased their net long positions in European carbon allowances to a new multi-year high last week, climbing 1 million tonnes from the prior week.