Drax To Pay £25 Million After Ofgem Uncovers Reporting Failures

January 7, 2025

‘Wind Of Change’: Labour Government Lifts De Facto Ban On Onshore Wind In The UK

January 7, 2025With energy bills on the rise there has never been a better time to future proof your business with solar panels. Installing a solar PV system not only reduces your electricity costs but also provides green electricity that reduces your carbon footprint and helps your business reach its sustainability goals.

Why Is Now The Perfect Time For Your Business To Invest In Solar?

INCREASING MARKETS

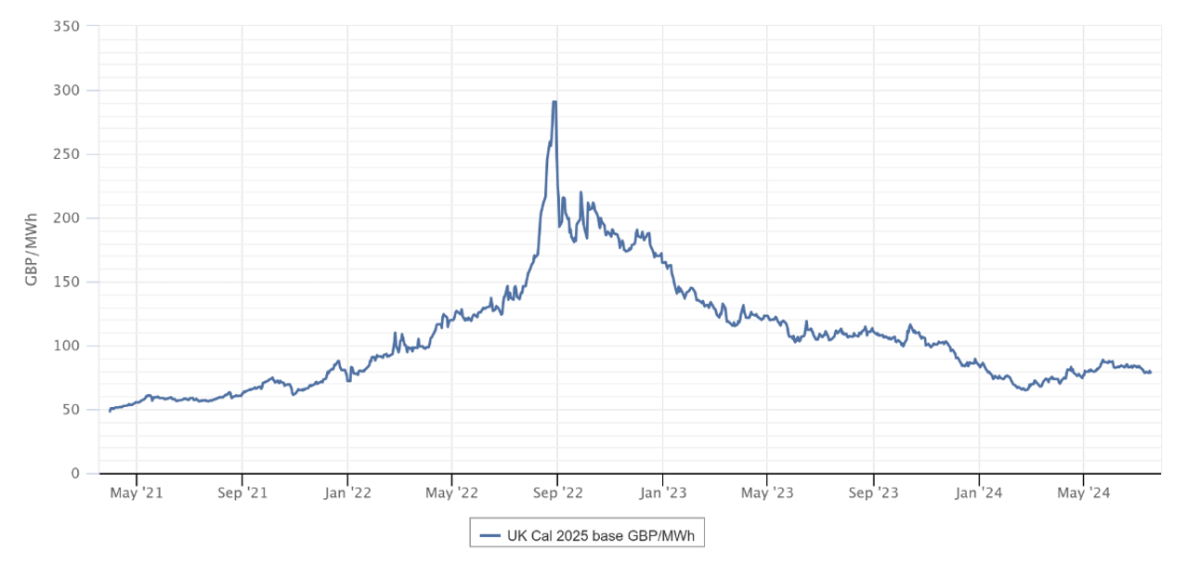

Through 2021 and 2022 UK and European electricity markets saw exponential price increases as countries looked for strategies to reduce and end reliance on Russian energy exports.

If your business has not yet seen the impact on current energy prices, it is likely at some point over the medium term your business energy rates will increase significantly.

Below summarises how electricity prices have increased.

We simplify this complex industry...

Our experts save you time and money, taking ownership of your business utility requirements

To provide context; before covid, the average electricity commodity price was approximately 5p/kWh, the commodity price for a two-year deal to begin on 01.10.2024 is currently trading at c8p/kWh, an increase of over 60%.

To minimise the impact of current energy markets, businesses must look at ways to reduce imported energy consumption from the grid. Installing solar PV will not only reduce grid consumption and help your business meet sustainability and carbon reduction goals, but there are also significant tax benefits for businesses who invest and install solar panels.

BUSINESS TAX BENEFITS

Businesses can benefit from the following Capital Allowance tax treatment if purchasing solar panels:

- 100% relief of the cost under the Annual Investment Allowance (set at £1m).

- If Annual Investment Allowance has been utilised, relief at 50% will be given via full expensing for Capital Allowances.

For a more detailed discussion on solar panels and a free desktop feasibility study to determine payback and funding options please contact hello@gleg.co.uk.