UK Energy Market Summary to Friday 29th July 2022

August 1, 2022Berlin, Brussels join calls for ‘fundamental reform’ of EU power market

September 1, 2022

CLOSING PRICES 12.08.2022

UK Gas & Electricity Markets

The NBP spot gas price fell by 12.6% to 8.5p/kWh on Wednesday as LNG arrival schedule to UK is healthy. The hot weather last week across UK and Europe saw cooling demand increase and with lower wind generation saw gas for power demand increase. Gas accounted for c60% of the UK electricity generation mix last week compared to an average of 43% for the last year.

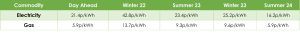

However, with volatility and large daily swings being normal in the current climate the NBP spot gas price spiked by 35.2% on Thursday to 11.5p/kWh after Gazprom revealed that the overhaul and maintenance of turbines required for the full operation of the Nord Stream 1 pipeline was being impeded by incomplete documents from Germany. Due to growing worries that the current supply shortfall would continue for a longer period of time, the price for Q4 22 delivery finished 2.4% higher at 17.0p/kWh. Below summarises curve prices on 12.08.2022.

Other Energy Markets

Bloomberg News reported that the UK was preparing for plans this winter which included several days whereby cold weather combined with gas shortages could lead to organised blackouts for industry in its “reasonable worst-case scenario”. BEIS advised this is “not something we expect to happen”, according to the report.

Oil prices rose on Thursday because of an increase in the International Energy Agency’s forecast for this year’s growth in oil demand as some consumers switch to oil due to rising natural gas prices. Consequently, WTI crude jumped by 2.6% to $94.34 a barrel and Brent crude increased by 2.3% to settle at $99.60 a barrel.

As energy markets continued to be robust and prices continued to set records because of concerns over gas delivery through the Nord Stream 1 pipeline, EUAs soared to a six-week high on Thursday. Thus, the price on Thursday ended 1.9% higher at 87.55 EUR/tonne.

Please contact hello@gleg.co.uk for a more detailed market analysis and expert view on how to navigate your energy procurement strategy through the current market volatility.