🇬🇧25 Years of UK Offshore Wind — A Milestone Worth Celebrating

December 11, 2025

GLEG UK Energy Market Update…

December 15, 2025Germany’s gas storage levels are dropping fast. By early December, inventories fell below 70%—a level that once triggered emergency measures and price spikes.

This time, prices aren’t reacting. The TTF benchmark remains comfortably below €30/MWh.

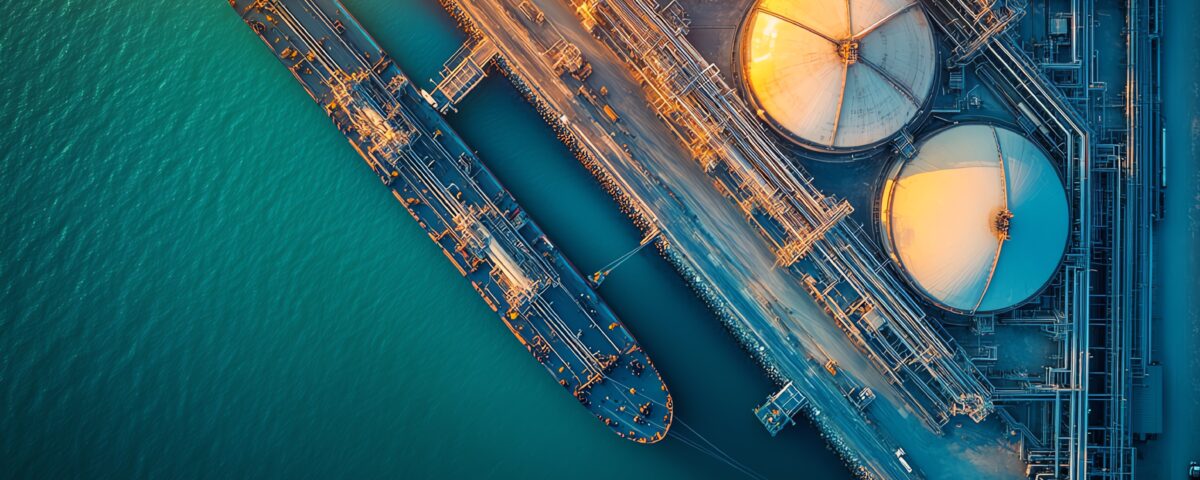

The reason is a shift in how gas markets are priced. Storage levels—the stock—are no longer the main signal. What matters now is flow: the reliability of global LNG supply. As long as gas keeps moving, lower inventories don’t automatically mean higher prices.

Three forces are reinforcing that confidence. US LNG exports are running near full capacity, with surplus cargoes flowing into Europe as Asian demand remains muted. A new LNG terminal on Canada’s Pacific coast is reshaping global trade flows, freeing up US supply for Europe. And the historic Asian price premium has largely disappeared as markets look ahead to a wave of new supply, particularly from Qatar later this decade.

Low storage still matters—but it no longer tells the whole story. In today’s market, confidence in LNG flows is outweighing concern about empty tanks. For now, storage is falling, but prices aren’t.

To discuss your business’s energy strategy contact us today at hello@gleg.co.uk.