Strengthening the UK’s Energy Security: A New Storage Facility in the Irish Sea

September 26, 2025

France’s Nuclear Strength to Power Winter Exports

September 30, 2025UK Energy Market Summary to Friday 26th September 2025

Closing prices 26.09.2025

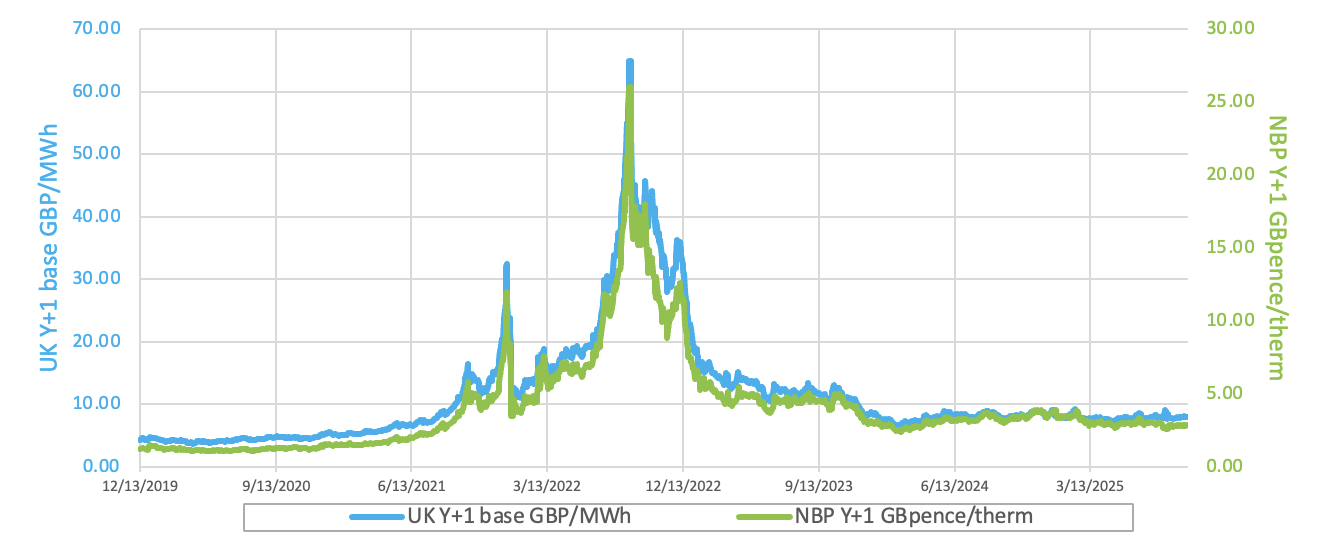

UK near-term gas prices decreased on Wednesday pressured by ample storage and muted weather-related demand. Consequently, NBP spot price fell by 2%, ending at 2.7 p/kWh. Further along the curve, NBP Win-2025 delivery contract slipped by 0.9% to settle at 2.9 p/kWh, amid high storage levels in the EU.

British near-term gas prices moved upwards amid expectations of colder weather likely to drive heating demand, even as flows from major supplier Norway increased. As a result, NBP spot increased by 2% to 2.7 p/kWh. Further out the curve, the gas price for Win-25 delivery rose by 1.5% to 2.9 p/kWh amid tight supply

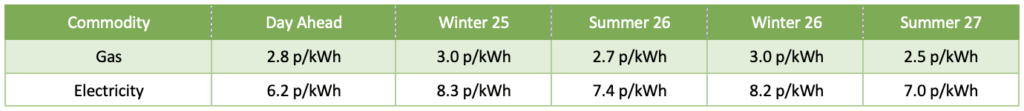

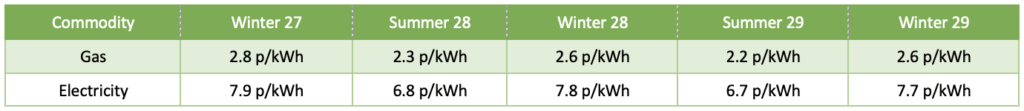

At time of writing, European gas storage levels are 82% full, with the UK 47% full. European gas storage levels are trending on the 5-year average compared to 2024. Over the past week gas has accounted for 31% of the UK generation mix with wind accounting for 25%, solar 8% and nuclear accounting for 8.7%. Below summarises curve prices as at close of business on Friday.

Curve UK Gas & Electricity Markets

Other Energy Markets

Crude oil prices stabilised on Thursday following a seven-week peak in the previous session, driven by Russia’s decision to limit fuel exports through the end of the year. However, gains were restrained by fresh U.S. economic data that dampened expectations for additional interest rate cuts.

European carbon prices fell on Wednesday, with market activity largely shaped by the midday options expiry. Positioning data revealed that investment funds now hold their most bullish stance in EUAs in over four years, while also lifting UKA exposure to an all-time high.