⚡ Brace for a Step Change: TNUoS Residual Charges to Surge in April 2026

October 17, 2025

Navigating the Impact of Non-Commodity Costs on Business Energy Budgets

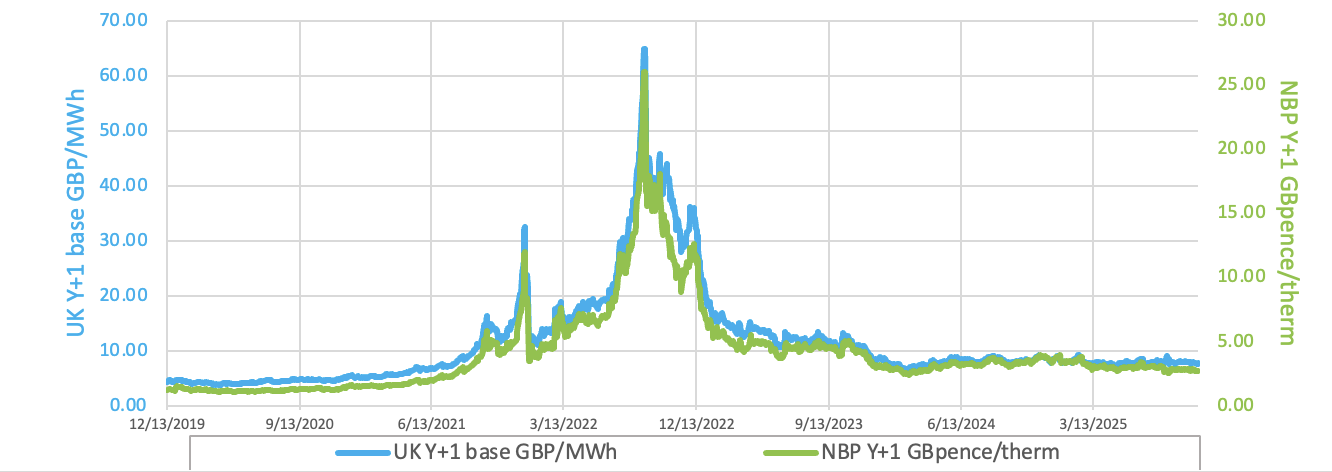

October 22, 2025UK Energy Market Summary to Friday 17th October 2025

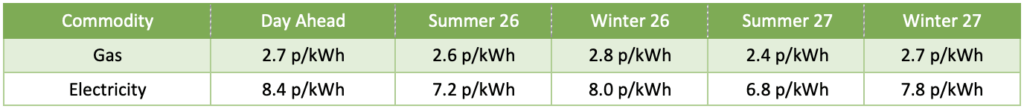

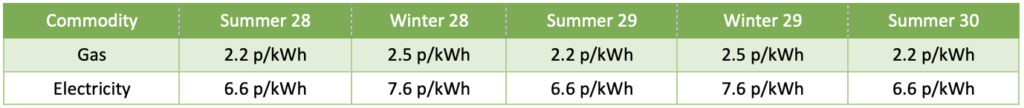

Closing prices 17.10.2025

Strong supply expectations also weighed on the forward curve. The Summer 2026 delivery contract edged 0.3% lower at 2.6 p/kWh, as EU LNG imports are set to rise 33% this winter, more than offsetting a projected 4 bcm drop in pipeline flows. European spot electricity prices extended losses on Wednesday.

The British spot gas price edged 0.4% higher at 2.8 p/kWh on Thursday, following overnight Russian drone and missile strikes on DTEK and Naftogaz facilities in Ukraine’s Poltava region, prompting Ukraine to consider boosting winter gas imports by 25%. Concerns over supply disruptions also lifted the forward market, with the Summer 2026 delivery contract increasing by 0.8% to 2.6 p/kWh. However, ample LNG availability capped gains.

At time of writing, European gas storage levels are 83% full, with the UK 53% full. European gas storage levels are trending around the 5-year average. Over the past week gas has accounted for 51% of the UK generation mix with wind accounting for 18%, solar 2% and nuclear accounting for 12%. Below summarises curve prices as at close of business on Friday.

Curve UK Gas & Electricity Markets

Other Energy Markets

Crude oil prices fell on Wednesday to a six-month low as escalating U.S.–China trade tensions and an IEA projection of a 2026 supply surplus weighed on the market. The IEA highlighted that higher Middle East production, combined with robust exports from the Americas, pushed global crude shipments in September up by 102 million barrels the biggest increase since the pandemic

Speculative buying supported European carbon prices on Wednesday, with net long positions in EUAs rising by 5.2 million reaching a seven-year high for the second consecutive week.