🤔 Why Falling Storage Levels No Longer Mean Higher Prices…

December 12, 2025

⚡ Labour Commits £2.5bn to Power the UK’s EV Future…

December 17, 2025UK Energy Market Summary to Friday 12th December 2025

Closing prices 12.12.2025

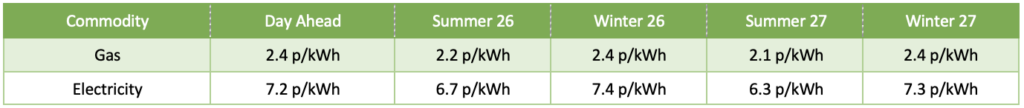

The British spot gas price dipped by around 3% to 2.3 p/kWh as mild weather, abundant LNG shipments and steady Norwegian pipeline flows outweighed concerns about relatively low storage levels. Investor caution weighed on the forward market, leading the Summer 2026 delivery contract to retreat by 2.8%, settling at 2.1 p/kWh.

A mild technical rebound pushed UK gas prices higher on Thursday, aided by lower wind output, and extended outages at the 595 MW Hartlepool 1 and 2 nuclear reactors through late December 2025. However, strong LNG supplies and rising Norwegian flows limited further gains. As a result, the British spot gas price rose by nearly 2% to 2.3 p/kWh.

At time of writing, European gas storage levels are 69% full, with the UK 52% full. European gas storage levels are trending around the 5-year average. Over the past week gas has accounted for 21% of the UK generation mix with wind accounting for 50%, solar 1% and nuclear accounting for 10%. Below summarises curve prices as at close of business on Friday.

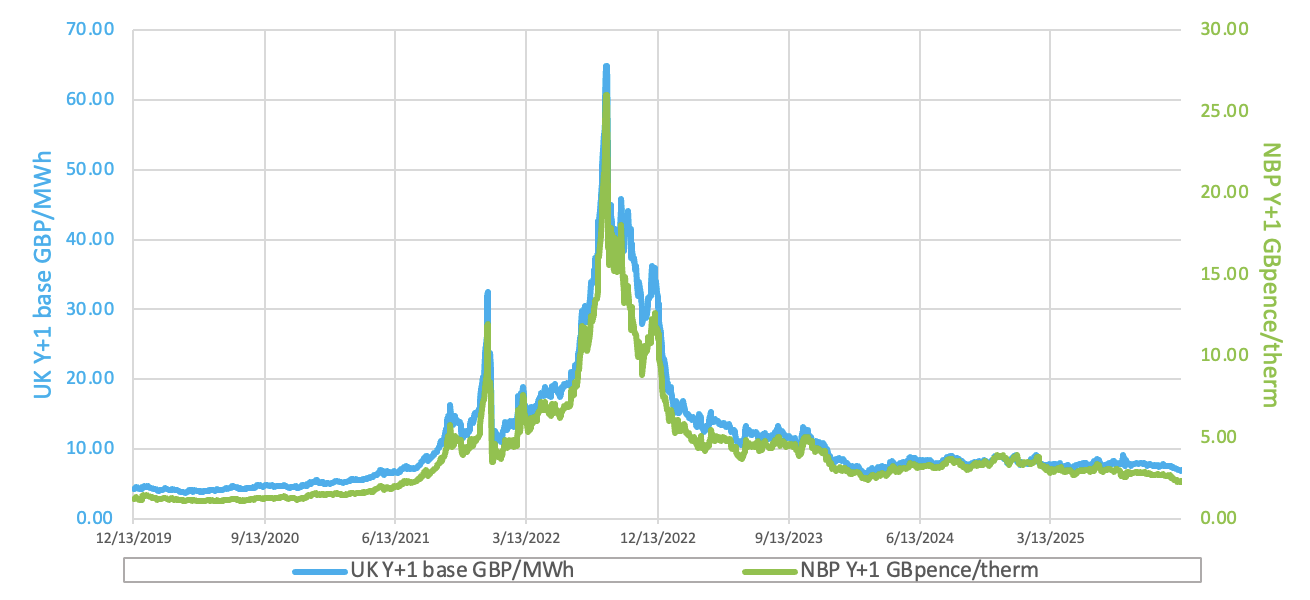

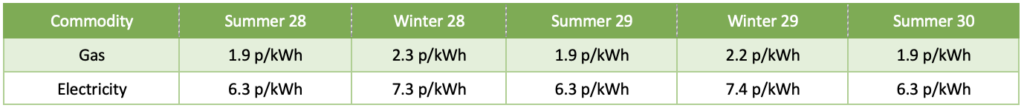

Curve UK Gas & Electricity Markets

Other Energy Markets

Crude oil prices rose slightly on Wednesday, bolstered by a larger-than-anticipated decline in U.S. crude inventories. API data indicated U.S. commercial crude stocks dropped by 4.8 million barrels in the week to 5th December.

On Thursday, European carbon prices strengthened as attention shifted from December options expiry to the medium-term supply outlook. Year-end support is expected to be stronger this year given tighter 2026 auctions.