Deepwater Wind Testing Facility Near Orkney Moves Closer to Reality

January 29, 2026UK Energy Market Summary to Friday 30th January 2026

Closing prices 30.01.2026

Expectations of rising US LNG deliveries and steady Norwegian supply weighed on UK spot gas, which fell by 1.7% to 3.4 p/kWh on Wednesday. Further along the curve, the Summer 2026 delivery contract advanced by 1.7% to 2.5 p/kWh, underpinned by low storage levels and the threat of colder weather. EU gas inventories were reported at 44%, down from the same period last year.

British near-term gas prices climbed on Thursday, buoyed by ongoing cold weather that lifted demand and maintained worries over low gas inventories. As a result, NBP spot increased by 1.5% to 3.5 p/kWh. Along the forward curve, the Summer-26 gas contract surged by over 6% to 2.9 p/kWh, as several US LNG facilities, including Freeport, remain below capacity, keeping an upward pressure on prices, despite a drop in US futures.

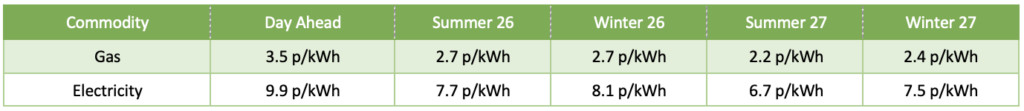

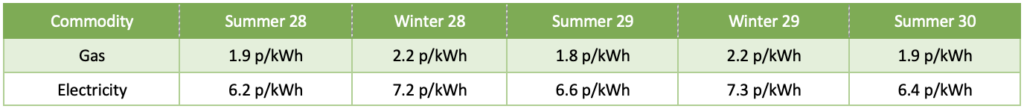

At time of writing, European gas storage levels are 41% full, with the UK 37% full. European gas storage levels are trending at the low of the 5-year average. Over the past week gas has accounted for 34% of the UK generation mix with wind accounting for 37%, solar 1% and nuclear accounting for 11%. Below summarises curve prices as at close of business on Friday.

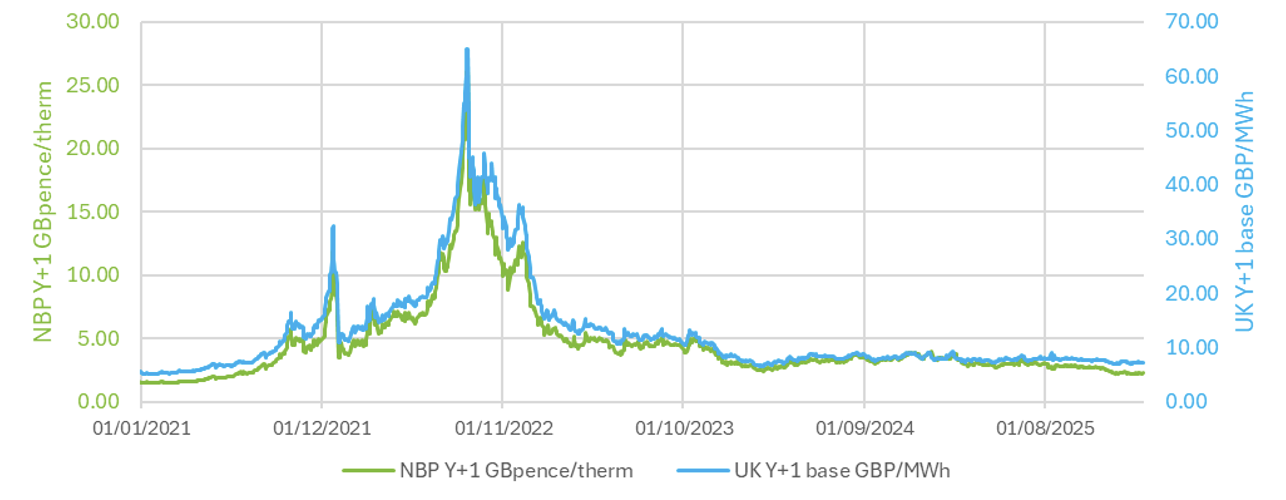

Curve UK Gas & Electricity Markets

Other Energy Markets

Thursday saw the third consecutive day of sharp gains on the international oil market. Rising US-Iran tensions have reignited uncertainty in the Middle East following last summer’s conflict involving the US and Israel.

Diverging from the trend in most other markets, European carbon prices fell sharply, pressured by geopolitical concerns and a wave of selling from speculative investors who had previously held sizeable long positions.