IPCC Report: On Reflection..

September 17, 2021Lithium – a sustainable opportunity to power our electric vehicles

October 25, 2021Centrica, owner of British Gas, has warned of soaring prices caused by a global supply crunch that could raise household bills and force energy-intensive businesses in the UK and Europe to curb activity this winter.

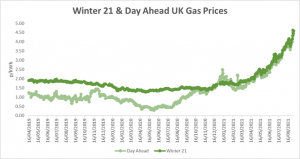

Natural gas prices are already at record levels for this time of year, trading at about five times their level of two years ago. There are fears that European countries could face supply issues this winter when demand is strongest because gas providers have been unable to fill storage during the summer. Below summarises how both day-ahead gas prices and prices for a winter 21 contract (from 01.10.21 to 31.03.22) have evolved over the last two years.

Due to low gas storage levels across the UK and Europe there is a larger than usual risk that if a cold winter hits Europe there is likely be even higher prices, leaving some energy-intensive companies who choose to buy on short term markets exposed to extortionate gas and electricity costs this winter.

High Demand for Gas

Natural gas, which is widely used in electricity generation as well as heating and industrial uses, has been in high demand globally in 2021. A prolonged winter in Europe and Asia has drained storage levels, while countries are increasingly prioritising the use of gas over coal because of its lower carbon emissions when burnt.

Asian countries including Japan, South Korea and China have been increasing imports of liquefied natural gas (LNG), which can be moved on tankers and has helped globalise a market that previously more heavily relied on pipelines and links to oil for pricing.

But strong demand has continued through the summer thanks to high temperatures in Asia boosting air conditioning demand and with more countries under environmental pressure to reduce reliance on coal.

Russia

Russia, the largest gas exporter to Europe, has been criticised for sending lower supplies this year, ahead of the start-up of the Nord Stream 2 pipeline to Germany. Gazprom, Russia’s state-backed monopoly pipeline supplier, indicated this week that the start-up of Nord Stream 2 later this year would not immediately increase planned supplies to Europe.

Carbon Prices and No Coal

In the UK and Europe, a surge in carbon prices, which raises the cost for utilities and industry of using polluting fuels, has also at times boosted demand for gas. Carbon prices in the EU are double the level of before the pandemic and the UK’s similar post-Brexit carbon contract is at similar levels.

Historically we would simply turn on coal power plants to help meet demand if Gas prices soared but this now not really an option given the high carbon price and the phaseout of coal generation in the UK.

Households

British households had a rise in the cost of living in August when the gas regulator announced that maximum gas prices for 11m families on variable contracts would increase by £139 to £1,277 a year.

Under a “price cap” system launched by former prime minister Theresa May in 2019, Ofgem can block gas suppliers from charging more than a central price calculated from various inputs.

The next review will take place in February and — if wholesale gas prices keep rising — would mean another spike in household bills in April. Ofgem estimates that wholesale prices make up more than a third of the average household gas and electricity bill.

National Grid ESO, the electricity system operator, said in its preliminary winter outlook earlier this summer that it was “confident there’ll be enough electricity to keep Britain’s lights on”. National Grid is due to publish its winter gas outlook later this year. It said LNG made up almost a fifth of UK gas supplies last winter, with imports from the EU making up about 10 per cent.

Large UK Manufacturers

Large manufacturers have been concerned about what one executive called a “massive increase” in energy prices in recent months.

Frank Aaskov, energy and climate change policy manager at UK Steel, said rising fuel costs were becoming a huge concern for energy-intensive sectors such as steel, though he stopped short of saying the industry may need to restrict production.

“The steel sector already faces uncompetitive electricity prices compared to their competitors in the EU . . . and the recent energy price increases have massively exacerbated this situation,” he said.

“A buoyant market and healthy material prices have cushioned this impact until now, but as we start to see steel prices soften in the months ahead, it could become a major issue.”