UK Offshore Wind Could Gain 4.3GW From £1.56bn Auction Boost

August 2, 2024UK Energy Bible Shows Demand Plummets To 1950s Levels

August 6, 2024UK Energy Market Summary to FRIDAY August 2024

Closing prices 02.08.2024

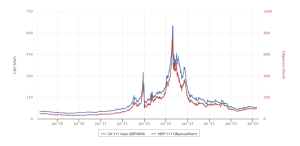

British near-term gas prices rose on Monday due to increased demand for cooling and continued to rise on Tuesday, driven by lower production levels. The NBP spot price closed at 2.7 p/kWh, increasing by 2% day-on-day. On the forward curve, the gas price for Winter 2024 gained 0.7%, closing at 3.4 p/kWh, influenced by concerns over potential supply constraints and disruptions.

On Wednesday, the NBP spot price closed at 2.98 p/kWh, increasing by 3% day-on-day. On the forward curve, the gas price for Winter 2024 gained nearly 2%, closing at 3.4 p/kWh, influenced by the crisis in the Middle East.

At time of writing, European gas storage levels are 85% full, with the UK 55% full. European gas storage levels have remained above the 5-year average throughout 2024. Over the past week gas has accounted for 29% of the UK generation mix with wind accounting for 13%, solar 12 % and nuclear accounting for 17%. Below summarises curve prices as at close of business on Thursday.

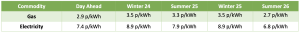

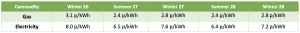

Curve UK Gas & Electricity Markets

Other Energy Markets

Oil prices rebounded on Wednesday, driven by escalating tensions in the Middle East following the assassination of Hamas’s leader by Israel. As a result, Brent crude rose by 2.7%, closing at $80.72 a barrel. Similarly, WTI crude increased by over 4%, settling at $77.91 a barrel. European carbon prices increased on Wednesday amid higher gas prices. Consequently, EUAs expiring in Dec-2024 closed at 69.21 EUR/tonne, increasing by 1%.