GLEG UK Energy Market Update…

May 14, 2024UK Energy Prices Expected To Decline, Calls For Long Term Solutions

May 22, 2024UK Energy Market Summary to Friday 17th May 2024

Closing prices 17.05.2024

On Wednesday, British near-term gas prices experienced a slight increase, driven by upcoming maintenance scheduled for next week in Norway. Hence, NBP spot settled 1.4% higher at 2.4 p/kWh.

British gas prices gained ground on Thursday due to Norwegian maintenance scheduled next week. As a result, NBP spot increased by about 3% to settle at 2.5 p/kWh. Further out the curve, the gas price for Win-24 delivery rose by 1.3% to close at 3.2 p/kWh. The risk of supply disruptions stemming from Middle Eastern and Russia-Ukraine geopolitical issues, as well as from reduced LNG supplies, lent support to prices.

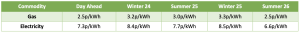

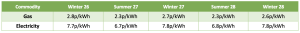

At time of writing, European gas storage levels are 66.53% full, with the UK 42% full. 2023/24 European gas storage levels have ended Winter 23 at record levels. Over the past week gas has accounted for 32% of the UK generation mix with wind accounting for 16%, solar 9% and nuclear accounting for 18%. Below summarises curve prices as at close of business on Friday.

Curve UK Gas & Electricity Markets

Other Energy Markets

Oil prices fell on Tuesday as signs of lower consumption in the US and a stronger dollar offset the risk premium associated with the Middle East situation and bullish OPEC outlook. As a result, Brent crude stood at $82.38 per barrel, while WTI crude settled slightly above $78 per barrel, with both contracts falling by more than 1% day-on-day.

On Wednesday, European carbon prices retreated, influenced by consistent selling that exerted continual pressure. The weekly Commitment of Traders data revealed yet another marginal reduction in investment funds’ net short position. As a result, EUAs expiring in Dec-24 declined by 1% to stand at 69.46 EUR/tonne.

Please contact hello@gleg.co.uk for a more detailed market analysis and expert view on how to navigate your energy procurement strategy through the current market volatility.