Denmark’s Offshore Wind Tender Faces Challenges as Industry Stalls

December 10, 2024

Global Emissions Climb To New Record High

January 5, 2025UK Energy Market Summary to Friday 13th December 2024

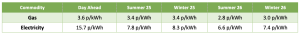

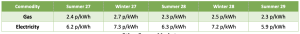

Closing prices 13.12.2024

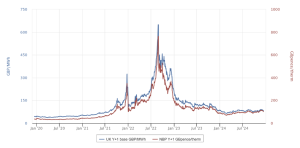

British near-term gas prices declined on Monday. The NBP spot fell by 3% to close at 3.8 p/kWh, as milder weather weighed on demand. Further along the curve, the NBP Sum-2025 contract lost over 3%, settling at 3.6 p/kWh, driven by increased LNG flows.

In the UK, short-term gas prices decreased on Wednesday, following predictions of milder weather. The NBP spot price fell by more than 2% to end at 3.8 p/kWh. On the forward curve, the NBP Sum-2025 also showed a downward trend, dropping 1.4% to close at 3.6 p/kWh. Consistent LNG flows further eased supply worries.

At time of writing, European gas storage levels are 80% full, with the UK 58% full. European gas storage levels are trending within the 5-year average throughout 2024. Over the past week gas has accounted for 40% of the UK generation mix with wind accounting for 33%, solar 1% and nuclear accounting for 10%. Below summarises curve prices as at close of business on Friday.

Curve UK Gas & Electricity Markets

Other Energy Markets

Oil prices increased by about 2% on Wednesday, buoyed by new sanctions imposed by the European Union on Russia’s “ghost fleet,” which is anticipated to affect the Kremlin’s oil exports. Brent crude finished at $73.52 per barrel, while WTI crude rose to $70.29 per barrel.

European carbon prices rose by roughly 0.7% on Wednesday, with the EUA Dec-2024 contract closing at 68.63 EUR/tonne, just before the option expiry.