Water Costs Are Rising: Why Now Is the Time to Act…

March 14, 2025

Global Recycling Day 2025

March 18, 2025UK Energy Market Summary to Friday 14th March 2025

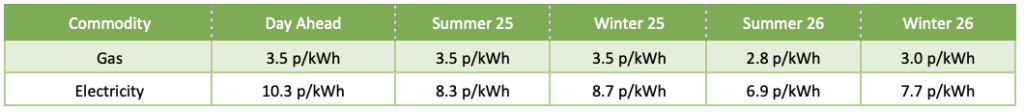

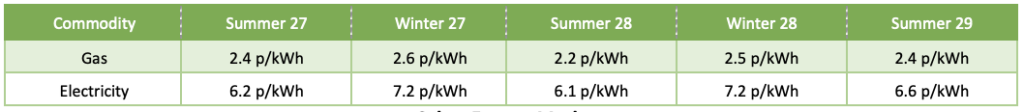

Closing prices 14.03.2025

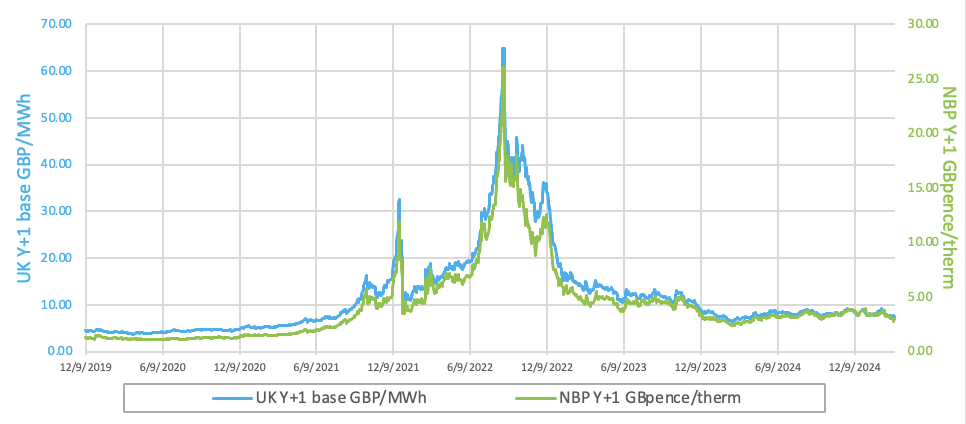

UK near-term gas prices decreased on Wednesday as stronger renewables weighed on gas-for-power demand. Consequently, NBP spot price fell by 3% to settle at 3.6 p/kWh. Further along the curve, NBP sum-2025 delivery contract dipped by 1.4% to close at 3.5 p/kWh amid eased geopolitical concerns in response to Russia’s and Ukraine agreeing to a 30-day interim ceasefire.

NBP Sum-2025 delivery contract dipped by nearly 1% to close at 3.5 p/kWh due to an expected increase in storage injections, which could help ease some of the buying pressure for the summer.

At time of writing, European gas storage levels are 36% full, with the UK 22% full. European gas storage levels are trending just below the 5-year average throughout 2024. Over the past week gas has accounted for 38% of the UK generation mix with wind accounting for 27%, solar 6% and nuclear accounting for 12%. Below summarises curve prices as at close of business on Friday.

Curve UK Gas & Electricity Markets

Other Energy Markets

Oil prices dropped on Thursday, weighed down by an International Energy Agency (IEA) report forecasting a global supply surplus in 2025, even if OPEC+ halts production increases after April.

European carbon prices gained ground on Wednesday supported by a sharp rally triggered by news that UK-EU carbon market linking was under “serious consideration.”