🔌 Major Power Outage Hits Spain and Portugal

April 29, 2025

EU’s Crackdown on Russia’s Shadow Fleet and Oil Phase-Out Strategies…

May 7, 2025UK Energy Market Summary to Friday 2nd May 2025

Closing prices 02.05.2025

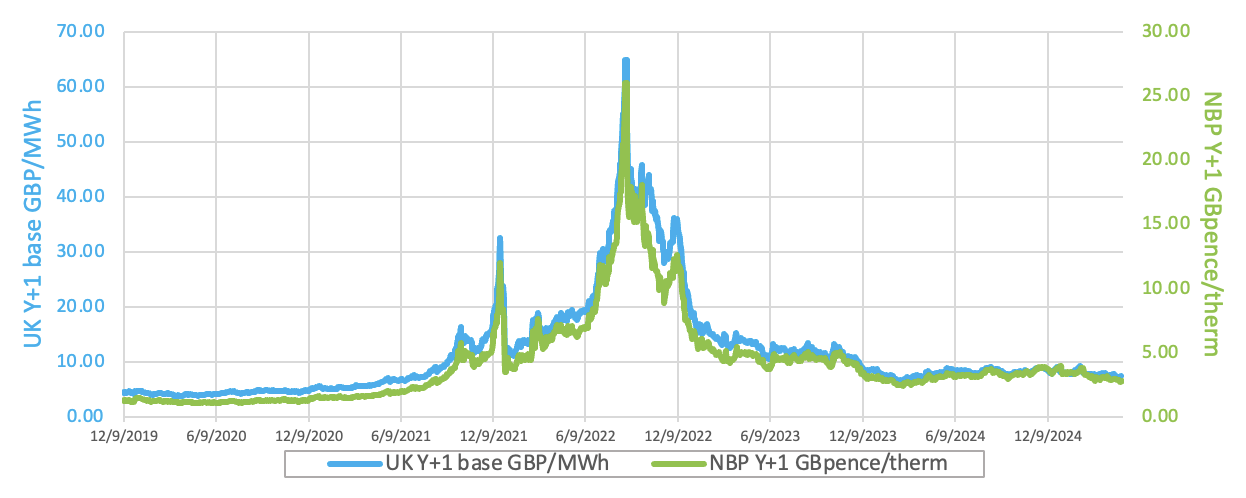

The British spot gas price edged 0.6% lower at 2.6 p/kWh on Thursday, driven by weak demand and reduced market activity due to warm weather forecasts and a Europe-wide holiday. On the forward curve, prices were pressured by increased LNG supply in recent weeks, supported by softer Asian demand and rising storage injections.

The British spot gas price jumped by 5% to 2.7 p/kWh on Friday, supported by maintenance at the Norwegian Kollsnes gas plant and thin market liquidity. On the forward curve, the Winter 2025 delivery contract rose by 2.4% to 3.1 p/kWh, following the diversion of several LNG cargoes from Europe to Asia amid narrowing price differentials.

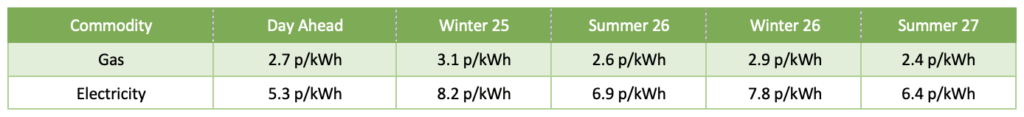

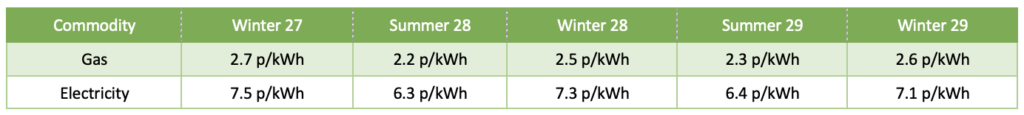

At time of writing, European gas storage levels are 41% full, with the UK 27% full. European gas storage levels are trending just below the 5-year average throughout 2024. Over the past week gas has accounted for 27% of the UK generation mix with wind accounting for 23%, solar 13% and nuclear accounting for 12%. Below summarises curve prices as at close of business on Friday.

Curve UK Gas & Electricity Markets

Other Energy Markets

A cautious tone was adopted by traders ahead of the upcoming OPEC+ meeting to decide June production levels, leading to downward pressure on crude oil prices. Supply increases were anticipated due to US and China negotiations.

European carbon prices edged higher on Thursday, despite subdued trading amid a public holiday across much of the continent, with buyers dominating the market. As a result, EUAs expiring in Dec-2025 increased by 0.7% to 67 EUR/tonne.