India-Pakistan Conflict: Impact on Regional Stability and Energy Infrastructure

May 8, 2025

What Businesses Need to Know About the RTS Metering Switch-Off

May 13, 2025UK Energy Market Summary to Friday 9th May 2025

Closing prices 09.05.2025

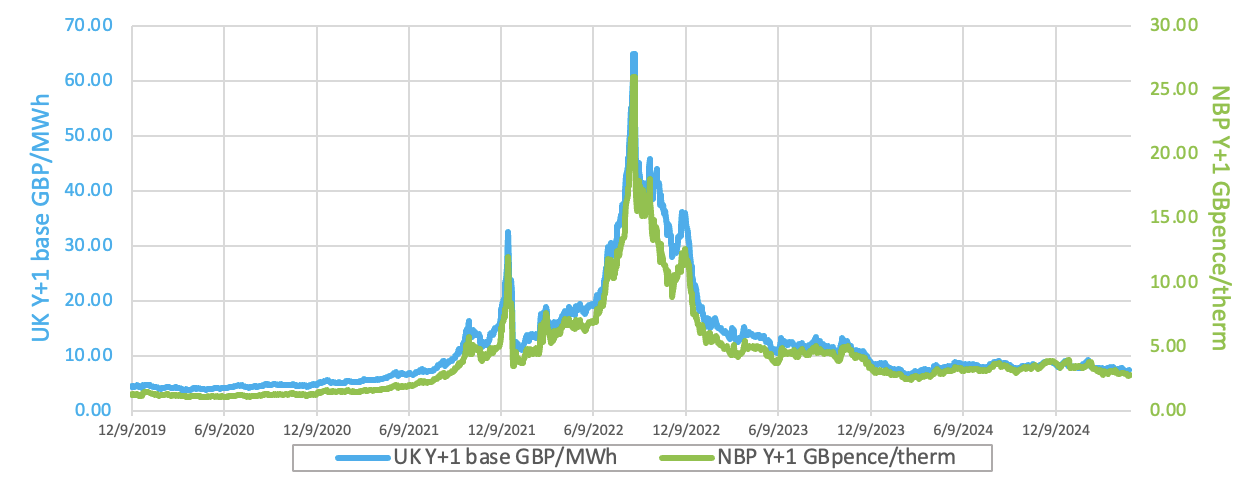

The British spot gas price slipped by 0.6% to 2.8 p/kWh, as reduced renewable generation across mainland Europe outweighed the impact of cooler weather. The Winter 2025 delivery contract retreated by 0.4% to 3.2 p/kWh, giving back some gains from a recent rally sparked by expectations of a Russian gas phase-out.

An increase in Norwegian imports weighed on the spot British gas market, leading to a slight decline in the NBP spot price, which edged 0.4% lower at 2.8 p/kWh. Nevertheless, the NBP Winter 2025 delivery contract rose by 1.4% to 3.2 p/kWh, supported by mounting concerns over delays in renewable deployment, ongoing geopolitical tensions, and revived hopes that improved U.S.-China relations might help reduce recession risks.

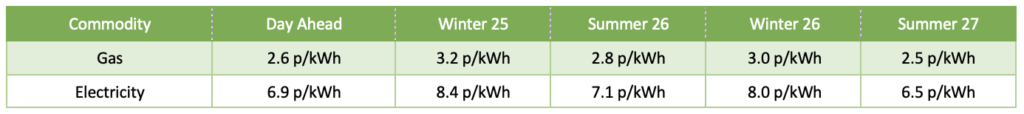

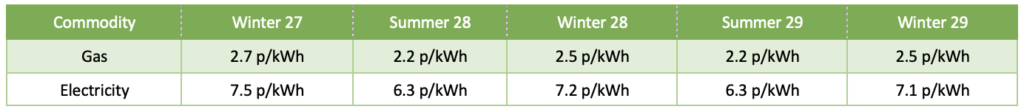

At time of writing, European gas storage levels are 42% full, with the UK 28% full. European gas storage levels are trending just below the 5-year average throughout 2024. Over the past week gas has accounted for 28% of the UK generation mix with wind accounting for 18%, solar 12% and nuclear accounting for 14%. Below summarises curve prices as at close of business on Friday.

Curve UK Gas & Electricity Markets

Other Energy Markets

Oil prices rose by around 3% on Thursday, supported by the announcement of a trade agreement between the United States and the United Kingdom, which boosted hopes for a broader easing of the trade war initiated by Donald Trump.

European carbon prices jumped to a six-week high on Wednesday, driven by a surge in speculative buying as traders held their largest net long position in a month. Hence, EUAs expiring in Dec-2025 climbed by 2.6% to around 71 EUR/tonne.