Zonal Pricing and Its Potential Impact on the UK Energy Industry

May 23, 2025

Climate Change Agreement Application Window Delayed

May 28, 2025UK Energy Market Summary to Friday 23rd May 2025

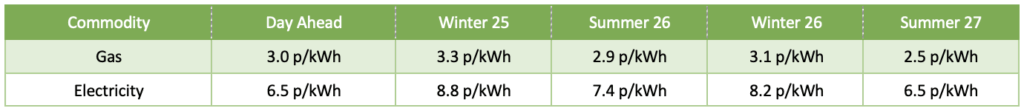

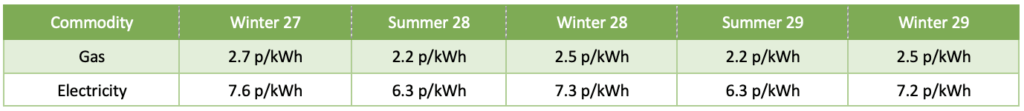

Closing prices 23.05.2025

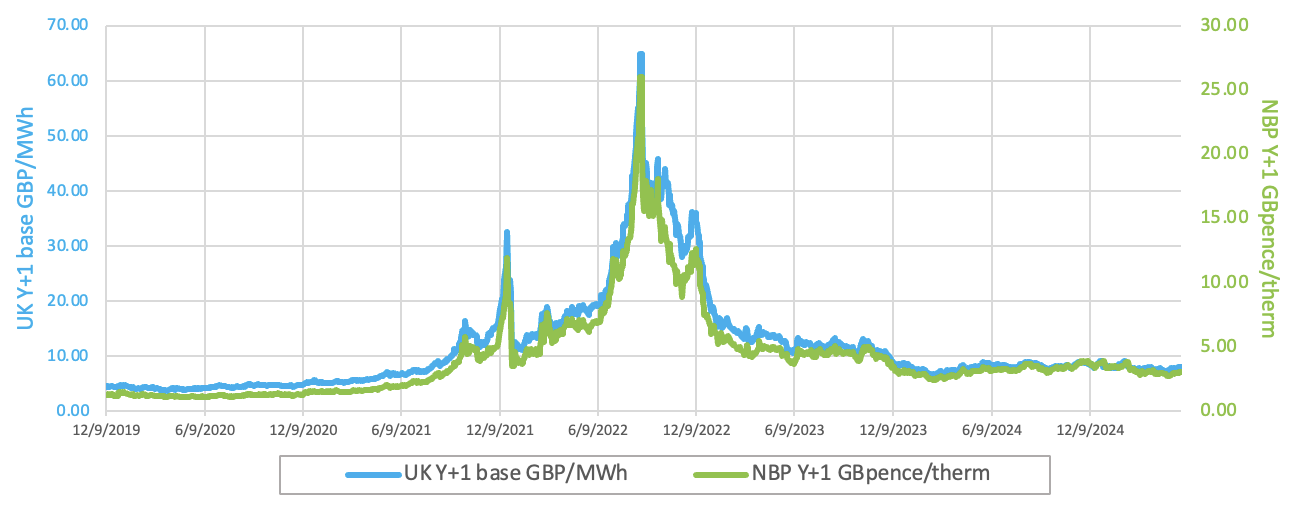

British gas prices declined on Thursday. The NBP spot price dropped by around 4%, closing at 2.9 p/kWh due to improved European gas supply. Similarly, on the forward curve, the NBP Winter 2025 delivery contract lost around 1%, settling at 3.3 p/kWh, weighed by higher stock levels.

UK near-term gas prices rose on Friday as a smaller unplanned outage at the Troll gas field led to a temporary supply reduction. Consequently, NBP spot price surged by 1.7% to settle at 3.0 p/kWh. Further along the curve, the NBP Win-2025 delivery contract edged 0.5% higher to close at 3.3 p/kWh, driven by geopolitical risks as the EU Commission is expected to propose a legal ban on Russian gas imports by 2027.

At time of writing, European gas storage levels are 46% full, with the UK 26% full. European gas storage levels are trending just below the 5-year average throughout 2024. Over the past week gas has accounted for 20% of the UK generation mix with wind accounting for 36%, solar 12% and nuclear accounting for 19%. Below summarises curve prices as at close of business on Friday.

Curve UK Gas & Electricity Markets

Other Energy Markets

Oil prices rose on Friday after U.S. President Trump postponed imposing a 50% tariff on EU imports until 9 July, easing trade tensions and supporting demand expectations. Additional support came from Geopolitical escalations.

European carbon prices extended losses on Thursday, following the downward trend in gas prices. As a result, EUAs expiring in December 2025 fell by 0.8%, closing at 72.15 EUR/tonne.