Climate Change Agreement Application Window Delayed

May 28, 2025

UK CfD Allocation Round 7 Set for August Launch

June 4, 2025UK Energy Market Summary to Friday 30th May 2025

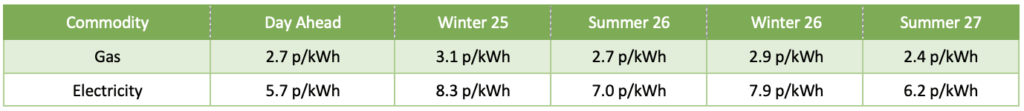

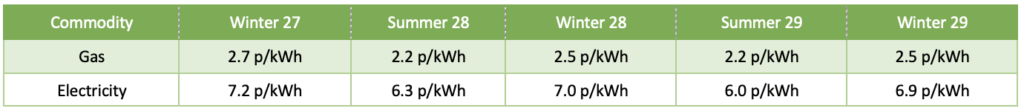

Closing prices 30.05.2025

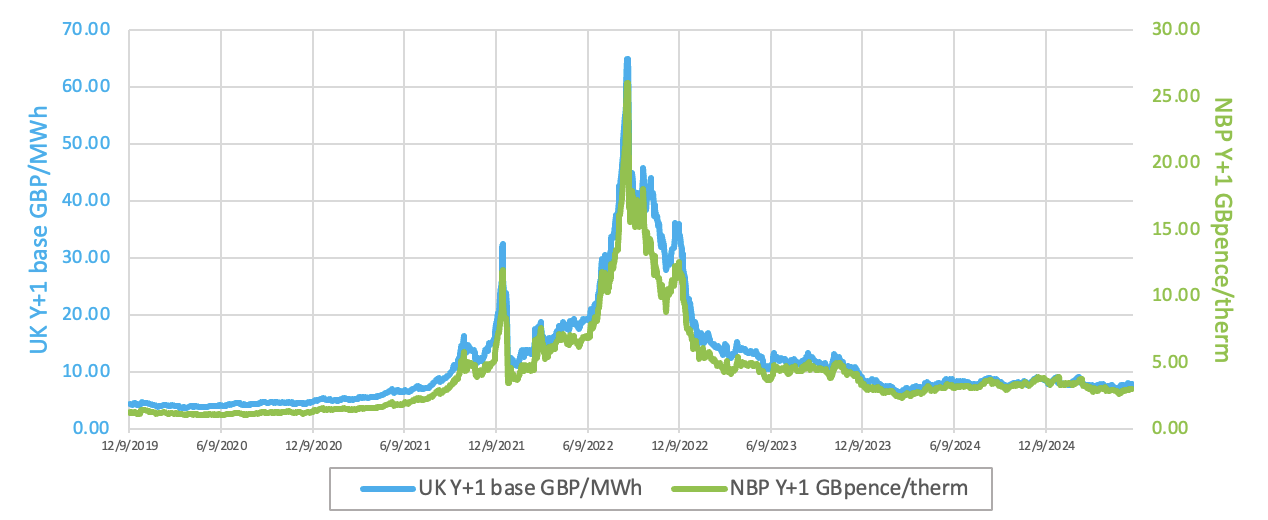

The British spot gas price edged 0.6% lower at 3.0 p/kWh on Wednesday, amid continued improvement in Norwegian pipeline flows. However, further declines were limited by ongoing maintenance and unplanned outages at the Visund and Troll gas fields. The Winter 2025 delivery contract fell by 0.5% to around 3.3 p/kWh, pressured by the lack of any breakthrough toward a peace deal in Ukraine.

Milder weather put pressure on the British spot gas price on Thursday. As a result, the NBP spot price slumped by over 6% to 2.8 p/kWh. On the forward curve, the Winter 2025 delivery contract dipped by 3.2% to around 3.2 p/kWh, influenced by Russian proposals for direct negotiations with Ukraine on June 2 and improved supply conditions across Europe.

At time of writing, European gas storage levels are 48% full, with the UK 26% full. European gas storage levels are trending just below the 5-year average throughout 2024. Over the past week gas has accounted for 14% of the UK generation mix with wind accounting for 44%, solar 11% and nuclear accounting for 18%. Below summarises curve prices as at close of business on Friday.

Curve UK Gas & Electricity Markets

Other Energy Markets

Crude oil prices rebounded on Wednesday, supported by speculation over new Russian sanctions and OPEC+’s decision to keep formal output quotas unchanged.

European carbon prices lost ground on Thursday, as weak demand overshadowed the impact of lower auction volumes due to the bank holiday. As a result, EUAs expiring in Dec-2025 dropped by 1.6% to nearly 71 EUR/tonne.