☢️ French Nuclear Concerns Resurface — What it Means for UK & EU Energy Markets

June 13, 2025

🔎 Key Net Zero & Clean Energy Takeaways from the UK’s 2025 Spending Review

June 16, 2025UK Energy Market Summary to Friday 13th June 2025

Closing prices 13.06.2025

Ongoing maintenance in Norway lent support to the British spot gas price on Wednesday. As a result, the NBP spot price increased by 1.5% to 2.8 p/kWh, also lifted by a two-week delay in Hartlepool 1 nuclear reactor’s return.

Concerns over lower French nuclear output this summer boosted the British spot gas price on Thursday. As a result, the NBP spot price climbed by over 4% to 3.0 p/kWh, amid fears that prolonged nuclear constraints in France could increase demand for gas-fired power to meet summer electricity needs. Further along the curve, the Winter 2025 delivery contract rose by 1.2% to 3.3 p/kWh, supported by EU storage levels at 52% – about 22 points below the same period last year.

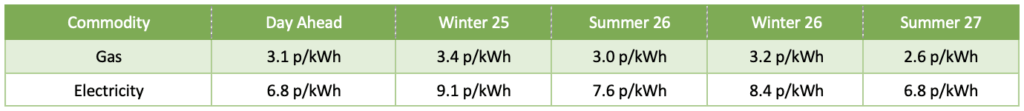

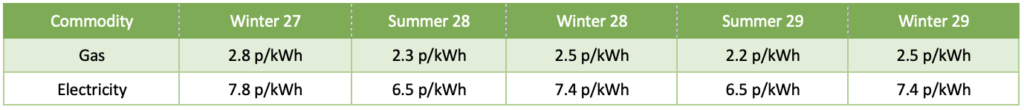

At time of writing, European gas storage levels are 53% full, with the UK 25% full. European gas storage levels are trending just below the 5-year average throughout 2024. Over the past week gas has accounted for 20% of the UK generation mix with wind accounting for 31%, solar 12% and nuclear accounting for 14%. Below summarises curve prices as at close of business on Friday.

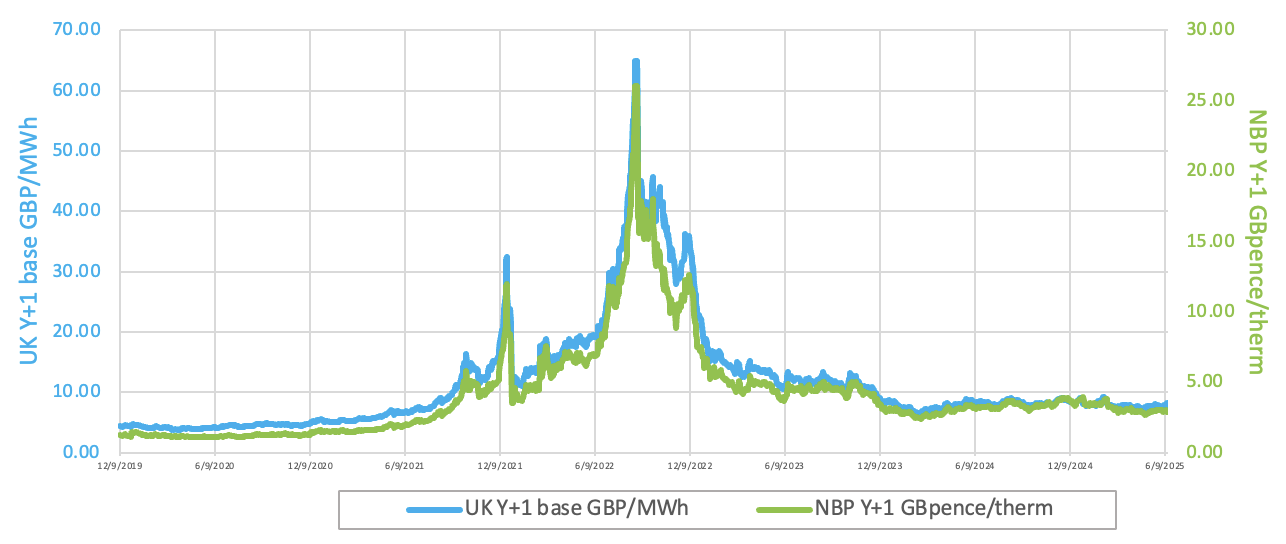

Curve UK Gas & Electricity Markets

Other Energy Markets

Crude oil prices edged down on Thursday as investors locked in gains after a 4% rally the previous day, driven by concerns over potential supply disruptions in the Middle East. A brief correction was expected, with technical indicators signalling overbought conditions.

European carbon prices extended gains on Thursday, as news of further investigations at French nuclear sites spurred renewed buying and hedging ahead of the June options expiry.