English PV Project Gets The Green Light

June 3, 2024Renewables Met 70% Of Portugal’s Demand In May…

June 6, 2024UK Energy Market Summary to Friday 24th May 2024

Closing prices 24.05.2024

The NBP spot price increased by about 2% on Tuesday, ending at 2.7 p/kwh, driven by stronger demand and reduced Norwegian flows due to planned outage. Along the forward curve, the gas contract for Win-2024 delivery surged by over 3%, closing at 3.4 p/kwh due to LNG supply concerns.

European spot electricity prices soared on Wednesday, influenced by falling wind and solar output. The spot power price in Germany rose by over 9% to settle at 93.87 EUR/MWh. On the other hand, the day-ahead French contract spiked by about 62% to settle at 48.43 EUR/MWh.

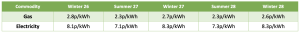

At time of writing, European gas storage levels are 69% full, with the UK 43% full. 2023/24 European gas storage levels have ended Winter 23 at record levels. Over the past week gas has accounted for 26% of the UK generation mix with wind accounting for 23%, solar 8% and nuclear accounting for 18%. Below summarises curve prices as at close of business on Friday.

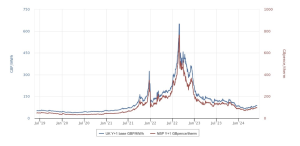

Curve UK Gas & Electricity Markets

Other Energy Markets

Oil prices declined for the fourth consecutive session on Thursday, hitting a 3-month low, weighed down by indications of robust US economic activity, which suggest the continuation of high interest rate policies. Hence, Brent crude dropped by 0.7% to settle at $81.36 per barrel, while WTI crude decreased by 1% to close at $76.87.

European carbon prices posted a marginal decline on Friday, in correlation with falling natural gas markets. As a result, EUAs expiring in Dec-24 stabilized at 75.61 EUR/tonne.

Please contact hello@gleg.co.uk for a more detailed market analysis and expert view on how to navigate your energy procurement strategy through the current market volatility.