UK Solar Roadmap Sets Bold Targets for 2030 – What It Means for Businesses

July 3, 2025

🌍 Energy Market Update

July 9, 2025UK Energy Market Summary to Friday 4th July 2025

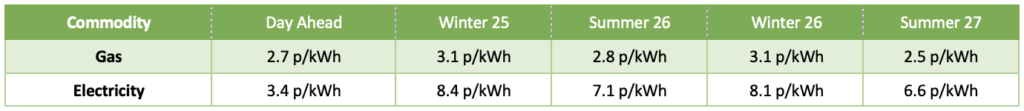

Closing prices 04.07.2025

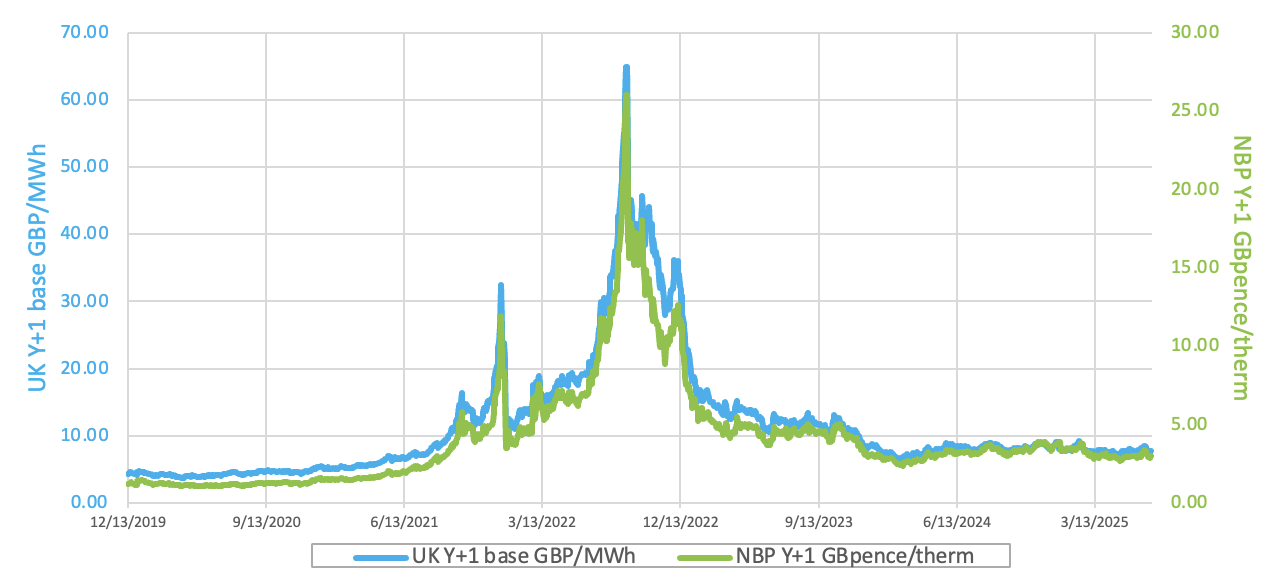

The NBP spot price fell by around 1% to 2.7 p/kWh on, influenced by consistent Norwegian exports and forecasts of cooler temperatures reducing gas demand for cooling. Meanwhile, new geopolitical tensions on Wednesday lifted forward prices.

Prospects of strong pipeline and LNG inflows drove the NBP spot price lower by 0.8% to 2.7 p/kWh on Thursday. Further along the curve, the Winter 2025 delivery contract fell by 0.3% to 3.1 p/kWh, pressured by the EU energy committee’s approval of rules requiring gas storage sites to be 90% full between 1 October and 1 December, replacing the previously strict 1 November deadline.

At time of writing, European gas storage levels are 60% full, with the UK 26% full. European gas storage levels are trending just below the 5-year average throughout 2024. Over the past week gas has accounted for 26% of the UK generation mix with wind accounting for 29%, solar 12% and nuclear accounting for 16%. Below summarises curve prices as at close of business on Friday.

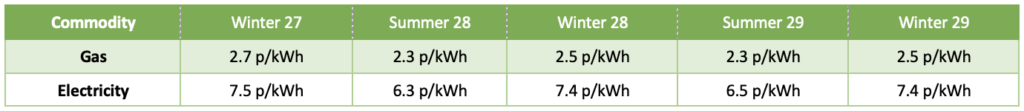

Curve UK Gas & Electricity Markets

Other Energy Markets

Crude oil prices edged down on Thursday amid growing worries that new U.S. tariffs might weigh on energy demand, particularly as major producers are expected to boost output.

The heatwave sustained upward pressure on European carbon prices on Wednesday, alongside a surge in short-covering after significant profit-taking in late June.