📈 Russian Gas Pipeline Flows to Europe Surge in July

August 6, 2025

Powering Britain’s Green Future: Incentives for Communities Supporting Renewable Energy Infrastructure

August 12, 2025UK Energy Market Summary to Friday 8th August 2025

Closing prices 08.08.2025

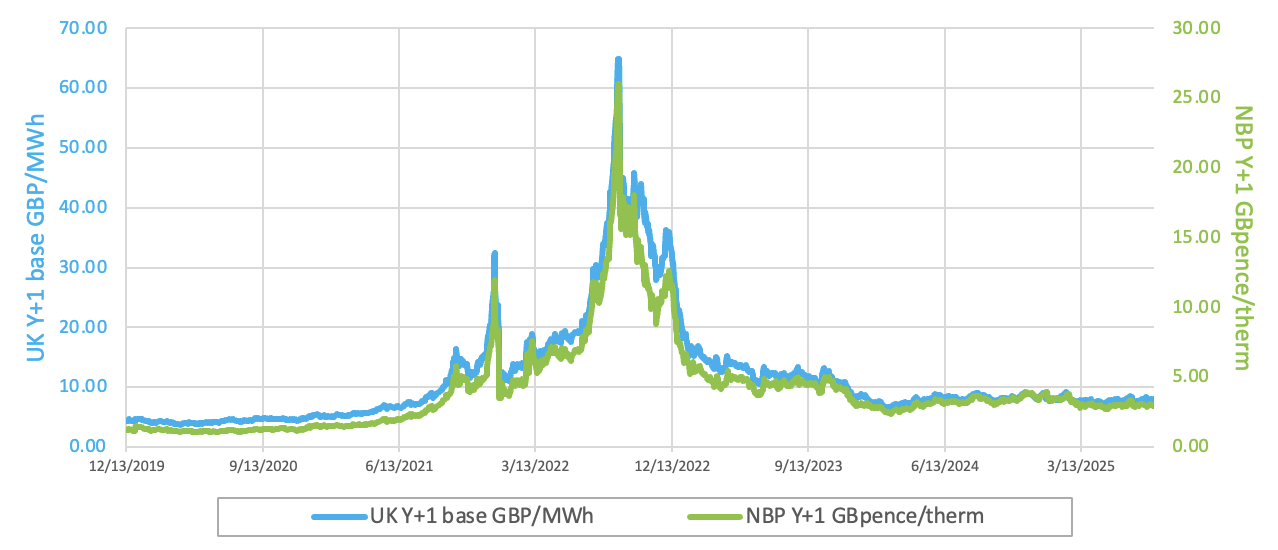

Robust supplies from major exporter Norway weighed on British gas prices on Wednesday, coupled with anticipated increases in French nuclear generation reducing gas demand. As a result, the NBP spot price dropped by nearly 2% to 2.7 p/kWh. On the forward curve, the Winter 2025 delivery contract dipped by 2.5% to 3.1 p/kWh, as gas storage levels continued to rise.

British near-term gas prices ended lower on Thursday due to weak demand and robust system supply. As a result, NBP spot decreased by 1.3% to 2.7 p/kWh. Further out the curve, the gas price for Winter 2025 delivery traded 1.5% lower at 3.1 p/kWh due to strong supply outlook.

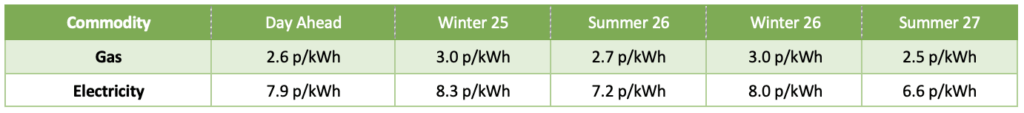

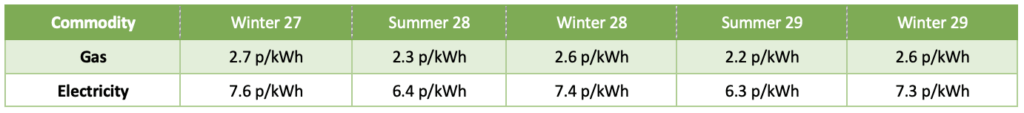

At time of writing, European gas storage levels are 72% full, with the UK 43% full. European gas storage levels are trending on the 5-year average compared to 2024. Over the past week gas has accounted for 17% of the UK generation mix with wind accounting for 41%, solar 13% and nuclear accounting for 12%. Below summarises curve prices as at close of business on Friday.

Curve UK Gas & Electricity Markets

Other Energy Markets

Uncertainty surrounding potential U.S. sanctions on Russia pushed crude oil prices down to an eight-week low on Wednesday. Brent crude traded over 1% lower to $66.89 per barrel. Meanwhile, WTI crude fell by 1.2% to $64.35 per barrel.

European carbon prices retreated on Wednesday amid muted activity across the wider energy complex. Consequently, EUAs expiring in Dec-2025 decreased by 0.8% to 71 EUR/tonne.