🚨 The Hidden Cost of “Wasted” Wind Power

October 2, 2025

Renewable Energy Surpasses Coal: A Global Turning Point

October 7, 2025UK Energy Market Summary to Friday 3rd October 2025

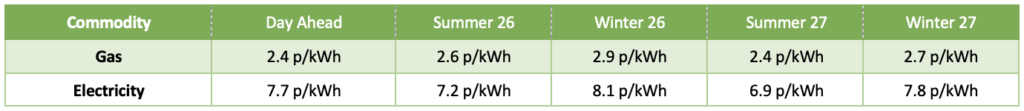

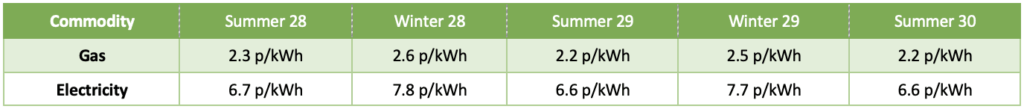

Closing prices 03.10.2025

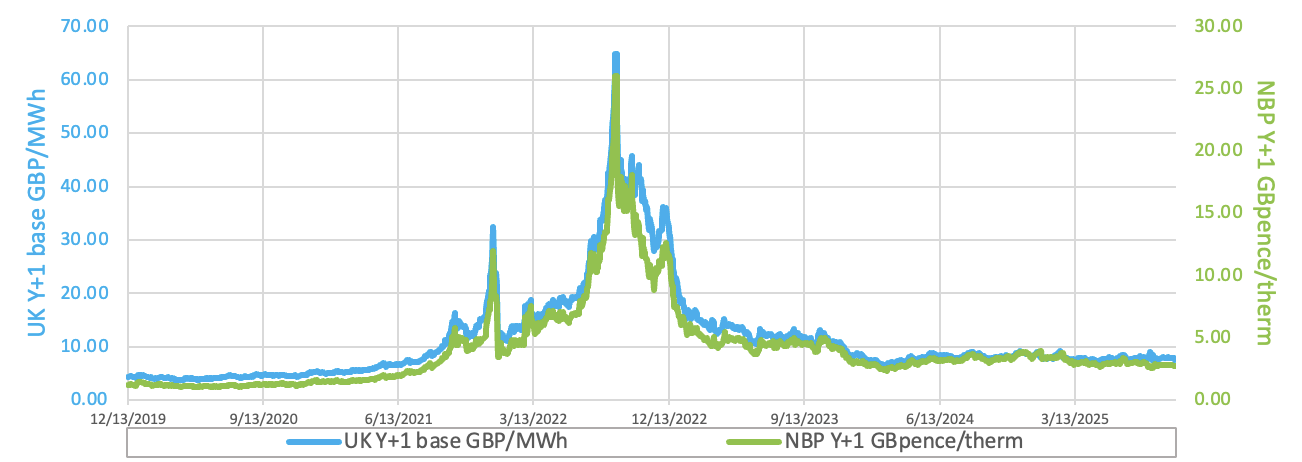

Weaker Asian demand, is easing supply pressures. As a result, the NBP spot price eased by 0.5% to 2.58 p/kWh on Wednesday, aided as well by the gradual return of Norwegian and Algerian exports after major maintenance. On the forward curve, the Summer 2026 delivery contract lost 0.3% to settle at 2.6 p/kWh, as winter outlooks remained broadly positive, supported by strong EU gas inventories.

Despite an unplanned outage at the Troll field, the NBP spot price tumbled by 10% to 2.3 p/kWh on Thursday, weighed by robust supply, ample storage, and mild weather. On the forward curve, the Summer 2026 delivery contract gained 0.2% to settle at 2.6 p/kWh, as ongoing concerns over geopolitically linked supply risks persisted, while subdued Asian demand capped the upside.

At time of writing, European gas storage levels are 82% full, with the UK 51% full. European gas storage levels are trending around the 5-year average. Over the past week gas has accounted for 27.5% of the UK generation mix with wind accounting for 43%, solar 5.5% and nuclear accounting for 8.5%. Below summarises curve prices as at close of business on Friday.

Curve UK Gas & Electricity Markets

Other Energy Markets

Crude oil prices stabilized on Thursday following a seven-week peak in the previous session, driven by Russia’s decision to limit fuel exports through the end of the year. However, gains were restrained by fresh U.S. economic data that dampened expectations for additional interest rate cuts.

European carbon prices recovered on Wednesday, driven by technical buying as traders with long positions reinforced their bullish outlook.