Market Excitement as Added LNG Exports Announced…

October 10, 2025

Oil Market Update: Volatility Persists Amid Shifting Geopolitical Landscape

October 14, 2025UK Energy Market Summary to Friday 10th October 2025

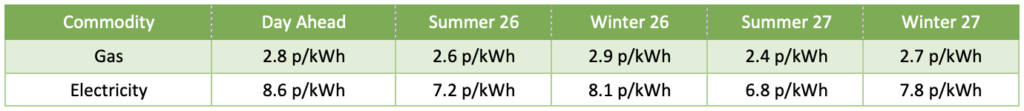

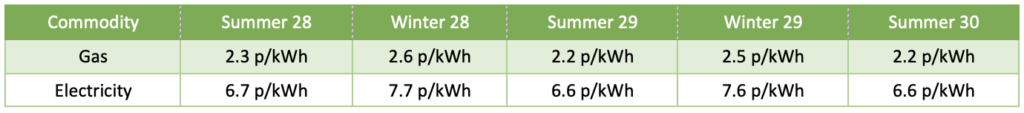

Closing prices 10.10.2025

On the forward curve, the Summer 2026 delivery contract dipped by 1.2% to 2.7 p/kWh, with the UK well-positioned for the winter heating season thanks to a year-on-year rise of more than 20% in LNG imports, reaching 8.4 bcm from January to September.

Expectations of ample LNG from the Atlantic basin this winter towards European markets eased British gas prices. Hence, the NBP spot price edged 0.5% lower at 2.8 p/kWh on Thursday. Additionally, weak Chinese demand, due to sluggish industrial activity, further relieved supply pressures. On the forward curve, the Summer 2026 delivery contract declined by 0.4% to 2.6 p/kWh, with National Gas and NESO forecasting ample winter supplies and electricity margins at six-year highs.

At time of writing, European gas storage levels are 83% full, with the UK 53% full. European gas storage levels are trending around the 5-year average. Over the past week gas has accounted for 43% of the UK generation mix with wind accounting for 24%, solar 4.7% and nuclear accounting for 9.9%. Below summarises curve prices as at close of business on Friday.

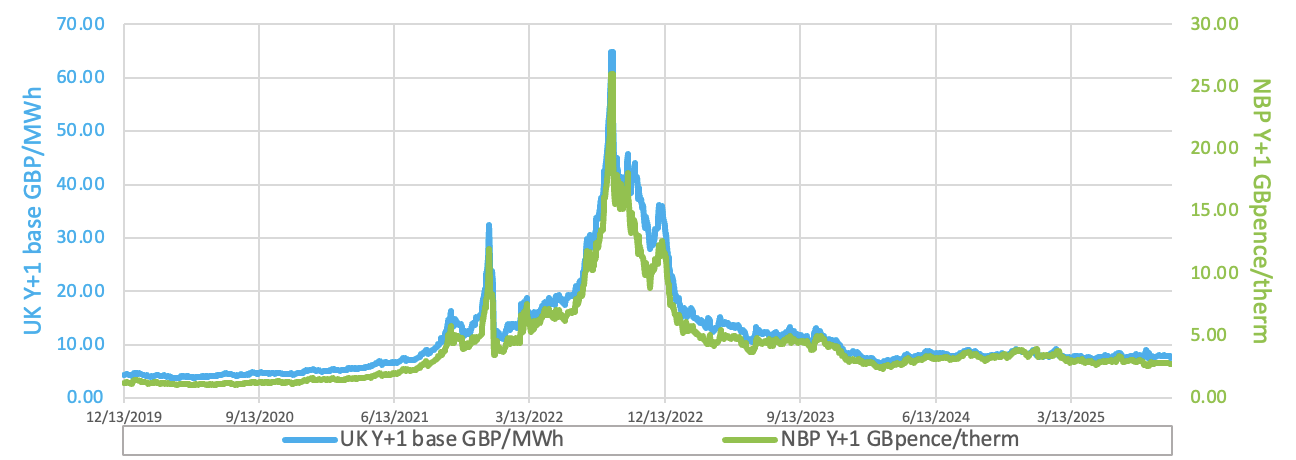

Curve UK Gas & Electricity Markets

Other Energy Markets

Crude oil prices dropped on Thursday following the announcement of a first-phase Gaza peace plan between Israel and Hamas, which eased some regional tensions. The agreement represents a significant step that could curb Houthi attacks in the Red Sea and boost chances for an Iran nuclear deal.

A brief but intense burst of late-session buying lifted European carbon prices on Thursday, with the EUAs expiring in Dec-2025 up by 0.3% at 79.23 EUR/tonne.