General Election 2024: Your Guide To Energy And Green Economy Promises

June 28, 2024Energy Price Cap Decrease: A Missed Opportunity for Greater Savings

July 3, 2024UK Energy Market Summary to Friday 28th June 2024

Closing prices 28.06.2024

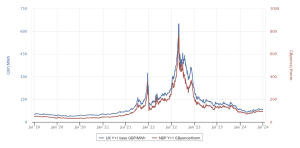

British short-term gas prices gained ground on Monday, with the NBP spot price rising by more than 2% to 2.8 p/kWh amid weaker wind output and rising cooling demand. Further along the curve, the gas price for Winter 2024 delivery edged 0.1% higher at 3.4 p/kWh, as supply concerns counterweighed high inventory levels.

British short-term gas prices declined on Wednesday, with the NBP spot price trading 3% lower at 2.7 p/kWh, influenced by higher wind power generation. On the forward curve, the gas price for Winter 2024 delivery decreased by 2% to 3.4 p/kWh. The end of the outage at Dvalin resulted in increased Langeled flows, while UK production remained stable.

At time of writing, European gas storage levels are 77% full, with the UK 45% full. 2023/24 European gas storage levels have ended Winter 23 at record levels. Over the past week gas has accounted for 24% of the UK generation mix with wind accounting for 23%, solar 11% and nuclear accounting for 19%. Below summarises curve prices as at close of business on Friday.

Curve UK Gas & Electricity Markets

Other Energy Markets

Oil prices climbed on Monday, buoyed by hopes of stronger demand in the United States, which is betting on a drop in crude inventories over the summer, and by geopolitical risks. As a result, Brent crude increased by 1%, settling slightly above $86 a barrel, while WTI crude gained over 1% to end at $81.63.

European carbon prices dropped on Wednesday as weekly position data showed that investment funds had reduced their holdings for the fourth consecutive week. Bearish gas prices also weighed on the market. Hence, the EUA expiring in Dec-24 dropped by 1.5%, reaching slightly below 67 EUR/tonne.

Please contact hello@gleg.co.uk for a more detailed market analysis and expert view on how to navigate your energy procurement strategy through the current market volatility.