Autumn Budget 2025: What It Means for Energy, Decarbonisation, and UK Businesses…

November 28, 2025

LNG Surplus Looms in 2026, Setting Stage for Lower Global Gas Prices

December 4, 2025UK Energy Market Summary to Friday 28th November 2025

Closing prices 28.11.2025

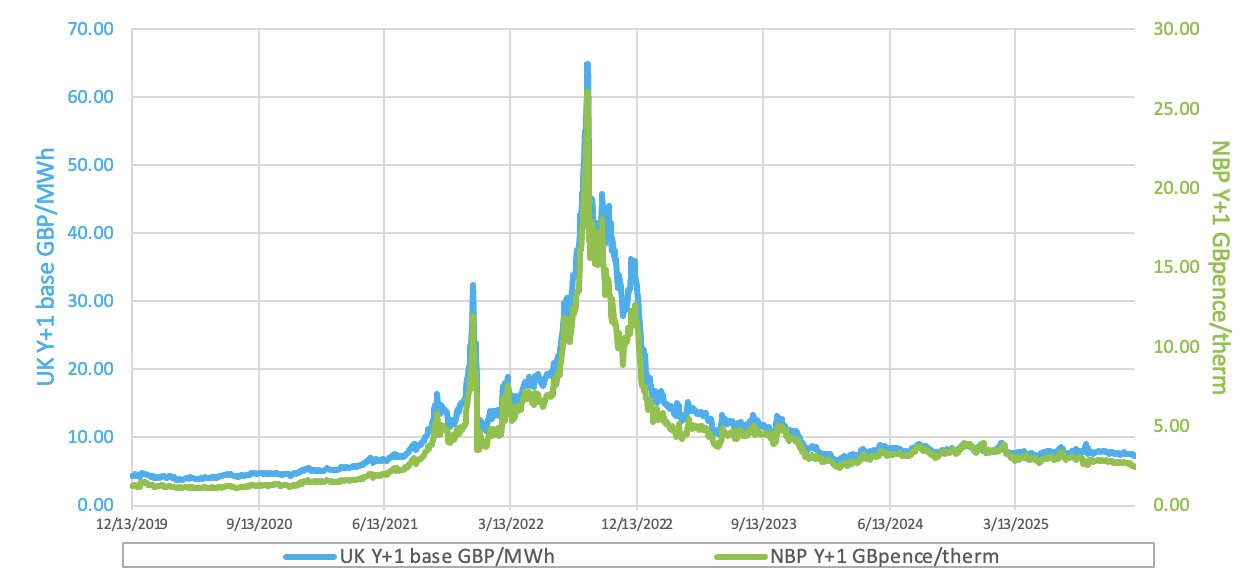

Mild weather forecasts and abundant gas supplies across Europe kept pressure on British gas prices, pushing the NBP spot price down by 1.7% to 2.6 p/kWh on Wednesday. On the forward curve, the Summer 2026 delivery contract declined by 0.8%, settling at 2.4 p/kWh, as geopolitical risks eased after Zelensky largely endorsed a US peace plan in a speech to European leaders.

Soft fundamentals weighed on British gas prices on Thursday, with mild early-December weather and robust LNG deliveries offsetting earlier geopolitical-driven volatility. As a result, the NBP spot price dropped by 1.5% to 2.6 p/kWh.

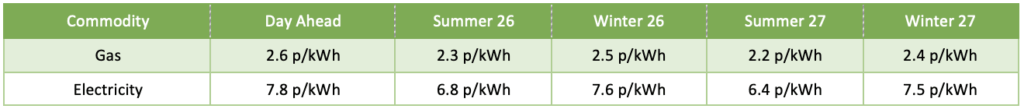

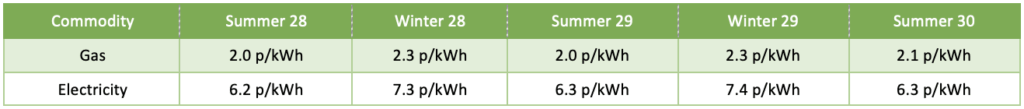

At time of writing, European gas storage levels are 76% full, with the UK 55% full. European gas storage levels are trending around the 5-year average. Over the past week gas has accounted for 30% of the UK generation mix with wind accounting for 42%, solar 2% and nuclear accounting for 12%. Below summarises curve prices as at close of business on Friday.

Curve UK Gas & Electricity Markets

Other Energy Markets

Crude oil prices recovered on Wednesday after U.S. inventory data showed a smaller-than-anticipated decline, with API reporting a 1.9 million-barrel drop versus the expected 2.4 million. While tentative signs of a Russia-Ukraine peace deal capped gains.

European carbon prices softened on Wednesday after the latest ICE COT report revealed that speculative traders trimmed their net long positions in EUAs for the first time in a month.