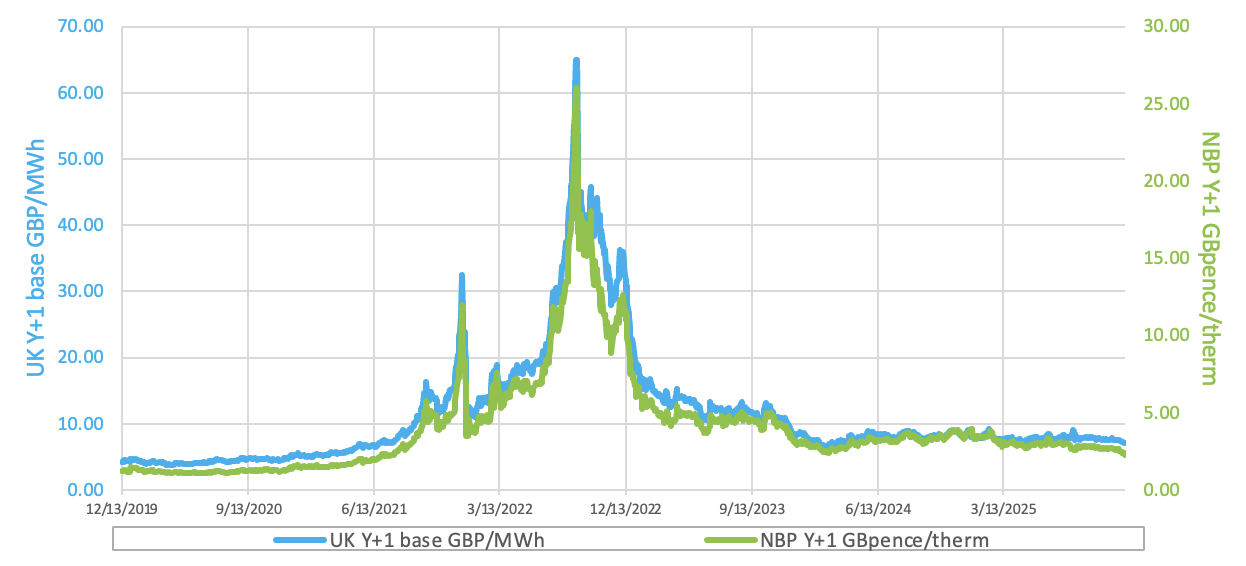

LNG Surplus Looms in 2026, Setting Stage for Lower Global Gas Prices

December 4, 2025

A Major New Government Scheme to Cut Manufacturers’ Electricity Bills…

December 10, 2025UK Energy Market Summary to Friday 5th December 2025

Closing prices 05.12.2025

The British spot gas price slipped by 0.3% to 2.5 p/kWh on Wednesday, as ample supply, including strong LNG inflows, offset an 8 mcm drop in Norwegian pipeline flows. On the forward curve, the Summer 2026 delivery contract added 0.3%, settling at 2.3 p/kWh, supported by storage dipping below 75%, though mild weather was expected to limit demand.

Restored Norwegian production after outages added to supply, pushing the British spot gas price down by 6% to 2.3 p/kWh on Thursday. With Asia’s benchmark LNG price at a 3.5-month low, the forward curve also retreated. The Summer 2026 delivery contract decreased by 3.2%, settling at 2.2 p/kWh, as weak Asian LNG demand kept European supplies ample.

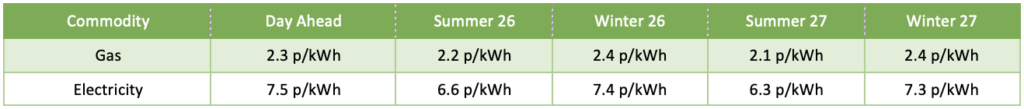

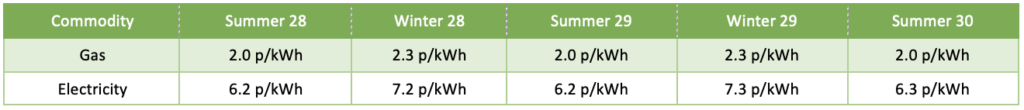

At time of writing, European gas storage levels are 73% full, with the UK 53% full. European gas storage levels are trending around the 5-year average. Over the past week gas has accounted for 30% of the UK generation mix with wind accounting for 41%, solar 1% and nuclear accounting for 11%. Below summarises curve prices as at close of business on Friday.

Curve UK Gas & Electricity Markets

Other Energy Markets

Crude oil prices rose on Wednesday after U.S.–Russia talks failed to secure a Ukraine peace deal that could have eased sanctions on Moscow, though oversupply concerns limited gains.

Record speculative net-long positions in EU carbon and the largest net-short stance in TTF gas since June 2023 did little to move European carbon prices, which ended Wednesday mostly flat.