UK Energy Outlook 2026: Key Risks and Opportunities for Businesses

January 2, 2026

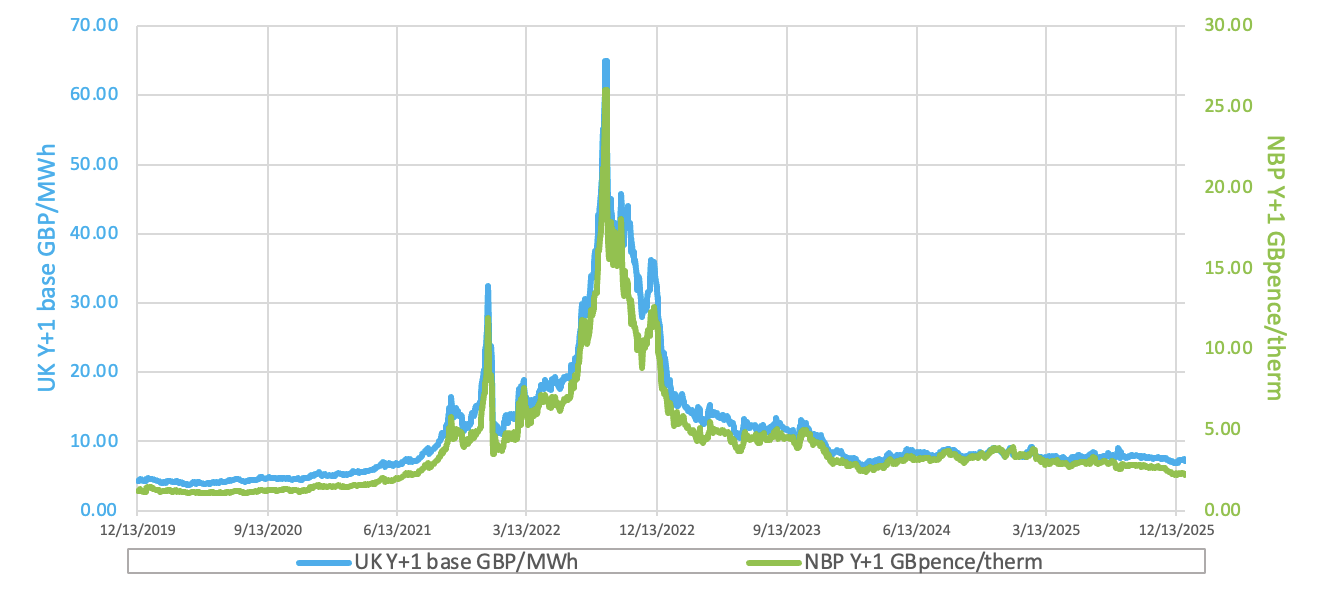

If This Was 2022, Prices Would Be Exploding. Here’s Why They’re Not…

January 7, 2026UK Energy Market Summary to Friday 2nd January 2026

Closing prices 02.01.2026

Ample supply limited the impact of near-term cold weather forecasts, leading the British spot gas price to fall by 2.6% on Tuesday. Further along the curve, the Summer 2026 delivery contract decreased by 2.2% to 2.2 p/kWh, weighed by strong LNG inflows, which hit a seasonal peak of around 375 mcm/day, according to Gas Infrastructure Europe (GIE).

On Thursday, the NBP spot price held steady at 2.6 p/kWh, with muted holiday trading and healthy supply conditions counteracting upward pressure from colder temperatures. On the forward curve, the Summer 2026 delivery contract was last priced at 2.2 p/kWh.

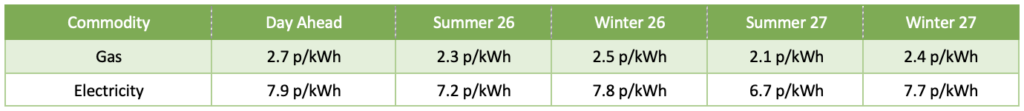

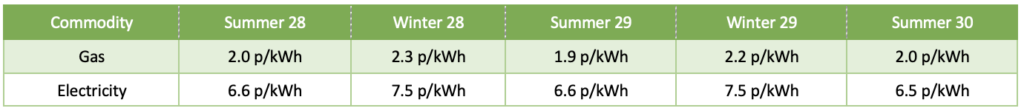

At time of writing, European gas storage levels are 60% full, with the UK 54% full. European gas storage levels are trending around the 5-year average. Over the past week gas has accounted for 24% of the UK generation mix with wind accounting for 42%, solar 1% and nuclear accounting for 12%. Below summarises curve prices as at close of business on Friday.

Curve UK Gas & Electricity Markets

Other Energy Markets

Crude oil prices were unchanged on Thursday, as thin trading during the New Year’s holiday limited price movement.

On Tuesday, European carbon markets declined marginally, with the EUAs expiring in Dec-2026 easing by 0.2% to 87.28 EUR/tonne amid weaker gas prices.