How do I measure the performance of my Energy Consultant?

September 1, 2020Streamlined Energy and Carbon Reporting

October 6, 2020There are opportunities for your business to receive rebates and on-going savings on your gas and electricity invoices.

Your business may be eligible for a 100% discount and four-year rebate on your climate change levy and up to an 85% discount on renewable taxes which account for one third of your bills.

If your business qualifies for these tax reliefs your energy rates will reduce by up to 35%.

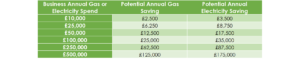

The below table summarises typical annual savings for businesses based on different levels of energy spend.

To understand whether you and your business qualify for the above savings please contact hello@gleg.co.uk for a no obligation free energy health check.

Energy Taxes – Why?

Energy taxes account for approximately 35% of your business energy invoices.

As the UK heads towards net zero by 2050, more and more clean generators are supplying electricity and gas to the grid. This is great for UK decarbonisation; however as renewable generation increases the amount of money required to pay renewable generators also increases.

Unfortunately, it is through your business energy invoices revenue is generated to pay renewable producers.

Energy Taxes – How?

The good news is most businesses are eligible for discounts and rebates on either gas or electricity. Ensuring your business optimise these tax breaks has a direct impact on your profitability.

How much could this be worth to you and your business?

We ensure your business optimises any energy tax savings available. We do this by initially conducting a free of charge energy health to identify savings available to you.

To understand whether you and your business qualify for the above savings please contact hello@gleg.co.uk for a no obligation free energy health check.

Chris Haines

Consultant, GLEG