Reducing Energy Costs Is Key to Meeting Britain’s Climate Goals

June 26, 2025

UK Solar Roadmap Sets Bold Targets for 2030 – What It Means for Businesses

July 3, 2025UK Energy Market Summary to Friday 27th June 2025

Closing prices 27.06.2025

The NBP spot price dropped by 1.4% to 82.60 p/therm on Wednesday, driven by a recovery in Norwegian gas flows to their highest since 17 May, prior to maintenance, and reports that Israel will restart operations and increase exports.

On the forward curve, prices were pressured by easing geopolitical concerns, as the maintained ceasefire between Iran and Israel reduced the risk of disruptions to LNG transit through the Strait of Hormuz. As a result, the Winter 2025 delivery contract dropped by over 3% to 93.10 p/therm.

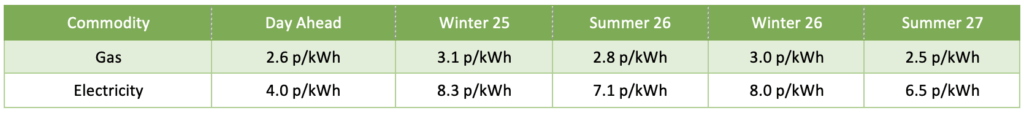

At time of writing, European gas storage levels are 58% full, with the UK 25% full. European gas storage levels are trending just below the 5-year average throughout 2024. Over the past week gas has accounted for 18% of the UK generation mix with wind accounting for 41%, solar 12% and nuclear accounting for 17%. Below summarises curve prices as at close of business on Friday.

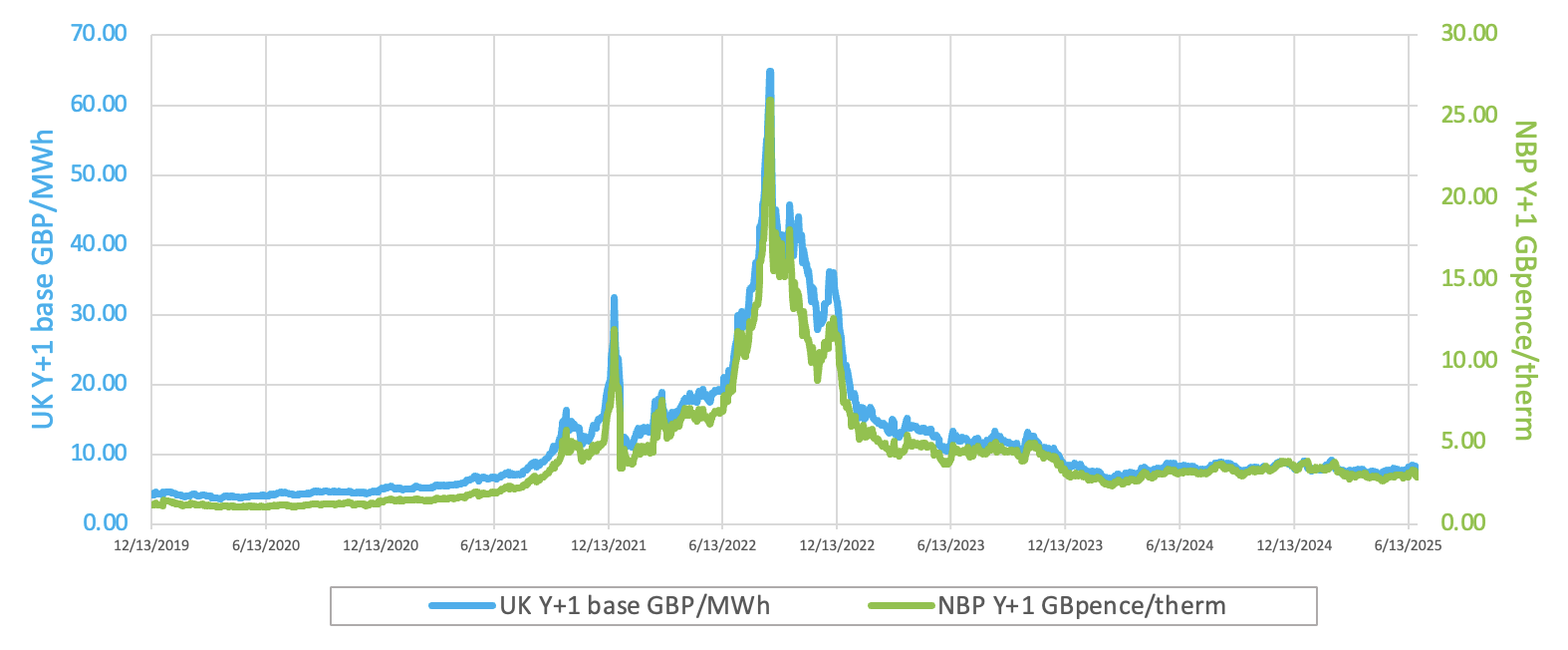

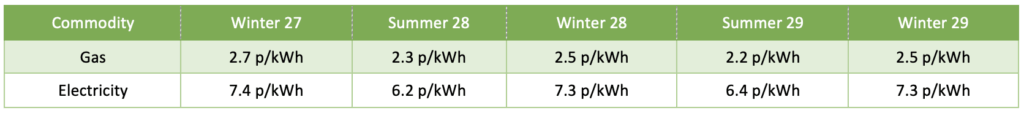

Curve UK Gas & Electricity Markets

Other Energy Markets

Crude oil prices rose on Wednesday, recovering from a two-week low, amid strong U.S. demand. U.S. crude inventories fell by 5.8 million barrels, far exceeding expectations of a 797,000-barrel draw, while gasoline stocks dropped by 2.1 million barrels as demand hit its highest since December 2021.

European carbon prices declined on Wednesday, weighed by profit-taking ahead of the June options expiry and weak trade data.