How Capacity Market Charges Impact Manufacturers — And What You Can Do About It

September 5, 2025

OPEC+ Moves Forward with Production Increases

September 9, 2025UK Energy Market Summary to Friday 5th September 2025

Closing prices 05.09.2025

British gas prices were mixed on Wednesday. NBP spot price decreased by 1.3% to 2.7 p/kWh amid plentiful renewable supply. Meanwhile, on the curve, the contract for delivery in Q1 2026 ended at 3.0 p/kWh, or a 0.6% increase amid expectations of colder weather forecasts and higher carbon prices.

British gas prices added ground on Thursday due to a drop in Norwegian output compared to last week as a result NBP spot increased by 2.4% to 2.7 p/kWh. On the curve, the contract for delivery in Q4 2024 rose by 0.8% to end at 2.9 p/kWh. European day-ahead power prices were bullish on Thursday, supported by higher demand. As such, the German spot power price edged 14% higher at 99.92 EUR/MWh and the French spot power price jumped by 85% to 56.70 EUR/MWh.

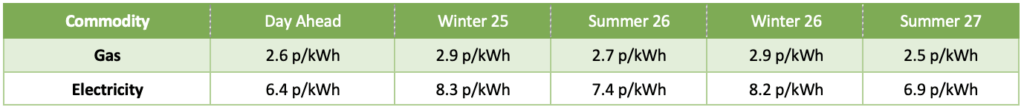

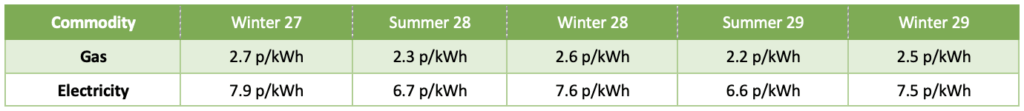

At time of writing, European gas storage levels are 79% full, with the UK 44% full. European gas storage levels are trending on the 5-year average compared to 2024. Over the past week gas has accounted for 21% of the UK generation mix with wind accounting for 39%, solar 8% and nuclear accounting for 13%. Below summarises curve prices as at close of business on Friday.

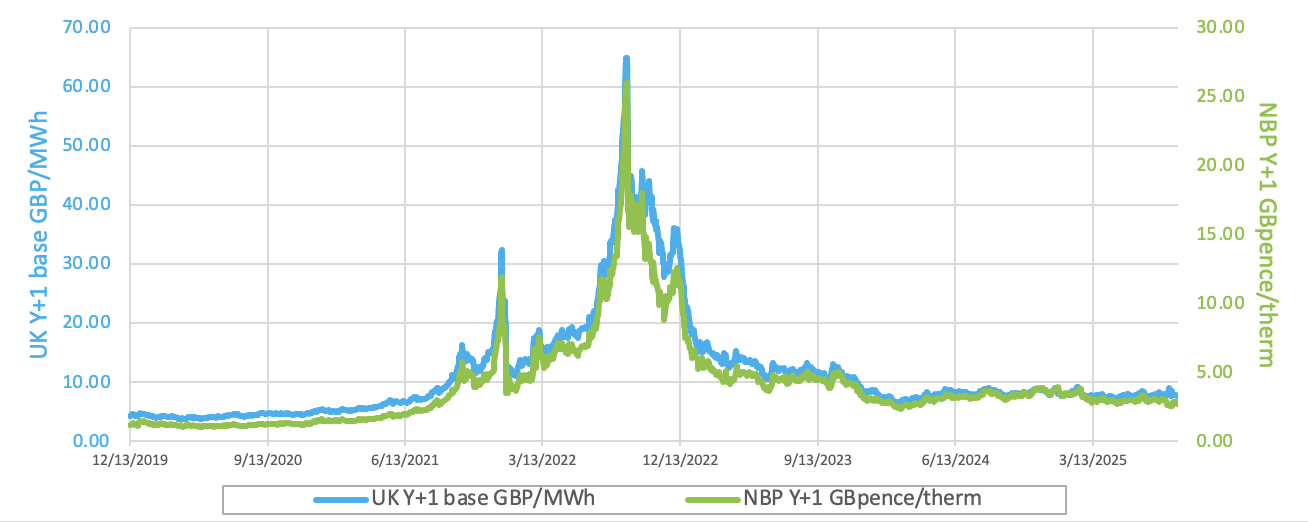

Curve UK Gas & Electricity Markets

Other Energy Markets

Crude oil prices continued to decrease on Thursday, on potential surplus output from OPEC members. Hence, Brent crude closed at $66.99 barrel, or a 0.9% fall. Similarly, WTI crude declined by 0.8% to $63.48 barrel.

European carbon prices continued to add momentum on Wednesday ahead of the 30th September deadline for compliance buying.